That is a question I often hear from young people.

In my career I have had the good fortune to meet and know many wealthy and successful people. I have observed these people closely and I have also studied the available research on what separates the rich and successful from everyone else.

At the core of anyone that has achieved success is someone who has good habits. They utilize their time wisely. They are disciplined and work hard.

Despite the popular narrative, the wealthiest Americans are not living on trust funds that were handed to them along with a silver spoon when they were born. Most got rich by simply working hard for it. In fact, wealthy households contain on average more than four times as many full-time workers as do poor households---1.97 workers per rich household compared to .42 earners per poor household. The fact is that there are not many "idle rich" folks in this country. There are, however, a lot of "idle poor".

If you don't believe it takes work to get to the top of the economic ladder just consider the differences in the traits between those that are wealthy and those that are poor in this research that compared the habits and traits of the two groups. Almost every one of these traits requires some work, effort or discipline on the part of the individual. It does not necessarily occur naturally in the human condition.

What you see is that those that succeed use their time more productively.

Wealthy Poor

Maintain a to-do-list 81% 9%

Wake up 3+ hours before work 44% 3%

Listen to audio books during commute 63% 5%

Network 5+ hours or more each month 79% 16%

Read 30+ minutes or more each day 88% 2%

Love to read 86% 26%

Watch 1 hour or less of TV everyday 63% 23%

Believe good habits create opportunity 84% 4%

If you work hard and use your time wisely it is difficult to not find success in life. As you see above, the wealthy believe that good habits create opportunity. They should know better than anyone.

You can be successful but that does not guarantee that you will be wealthy. There are many things in life that are rewarding that do not necessarily translate into increasing your financial net worth.

Becoming wealthy usually requires that you do at least two of these three things.

1. Get people working for you

2. Get your money working for you

3. Stay out of debt

Why is it difficult to become wealthy simply by your own labor and talents?

It is a question of time. We all only have so many hours in the day. We may be very productive but time is a finite resource. It is a limiting factor in utilizing our labor.

The amount that any one person is willing to pay another for their labor is also limited. For these reasons, it is hard to grow rich simply by your own individual labor.

Entertainers and professional athletes are exceptions to this rule. They are able to showcase their talents and labor to a broad audience and are able to get many, many people to pay them for it in the form of ticket prices or a media audience. However, each member of that audience is paying just a small price that gets leveraged with the size of the audience.

Inventors and authors are similarly advantaged. An invention that is used by millions of people or a best selling book creates large royalty payments that allow them to leverage their sole labor effort.

Most of us are not so fortunate. Therefore, if we are to become wealthy we have to leverage our time by getting other people to work for us whereby we gain a portion of their labor for our own benefit. Starting a business is the path that entrepreneurs follow to gain this advantage.

The other path is to simply work, save and invest and begin to get your money working for you through compound returns. As your money begins to work for you the need for you to labor to support yourself is reduced. If you can get enough money saved and invested you eventually do not have to labor at all. Your money does all the work to support your lifestyle.

It is hard to become wealthy carrying debt. Your lender may become wealthy. You will not. Borrowers are on the wrong side of compound returns. Getting compound returns to work for you is a path to riches. Paying interest on compounding debt leads to the poor house.

If you doubt any of this, consider this chart that compares the percent of assets and liabilities held by the wealthiest 1%, next 9% and the remaining 90% compiled by Edward Wolff of New York University.

It is a question of time. We all only have so many hours in the day. We may be very productive but time is a finite resource. It is a limiting factor in utilizing our labor.

The amount that any one person is willing to pay another for their labor is also limited. For these reasons, it is hard to grow rich simply by your own individual labor.

Entertainers and professional athletes are exceptions to this rule. They are able to showcase their talents and labor to a broad audience and are able to get many, many people to pay them for it in the form of ticket prices or a media audience. However, each member of that audience is paying just a small price that gets leveraged with the size of the audience.

Inventors and authors are similarly advantaged. An invention that is used by millions of people or a best selling book creates large royalty payments that allow them to leverage their sole labor effort.

Most of us are not so fortunate. Therefore, if we are to become wealthy we have to leverage our time by getting other people to work for us whereby we gain a portion of their labor for our own benefit. Starting a business is the path that entrepreneurs follow to gain this advantage.

The other path is to simply work, save and invest and begin to get your money working for you through compound returns. As your money begins to work for you the need for you to labor to support yourself is reduced. If you can get enough money saved and invested you eventually do not have to labor at all. Your money does all the work to support your lifestyle.

It is hard to become wealthy carrying debt. Your lender may become wealthy. You will not. Borrowers are on the wrong side of compound returns. Getting compound returns to work for you is a path to riches. Paying interest on compounding debt leads to the poor house.

If you doubt any of this, consider this chart that compares the percent of assets and liabilities held by the wealthiest 1%, next 9% and the remaining 90% compiled by Edward Wolff of New York University.

The top 1% has 63% of business equity (other people working for them), 55% of financial securities and 50% of stock & mutual funds (money working for them) but only have 5% of the debt (stay out of debt).

The bottom 90% has only 6% of business equity, 6% of financial securities, 9% of stocks & mutual funds but holds 74% of the debt. They also have 59% of the value of all personal residences. That may explain why the 2008-2010 period was so devastating for this group when housing prices collapsed in much of the country. It is also suggests that this risk could also form again---in particular if mortgage rates continue to go up.

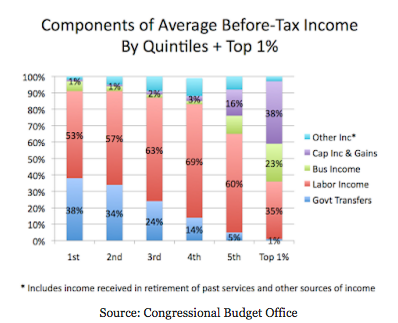

This data conforms with a chart I put together last year from IRS statistics (from 2013) comparing the sources of before-tax income based on the distribution by income groups (by quintiles plus the top 1%).

Notice that only 35% of the income of the Top 1% comes from labor income. 61% of their income is derived from business income (other people working for them) or investment income (their money working for them).

On the other hand, in the 3rd and 4th quintiles (the heart of the middle class), labor income makes up 66% of total income. Business and investment income are almost non-existent.

The rich become rich by building a business and/or saving and investing to get their money working for them. They also are careful in their use of debt.

Keep these lessons in mind if you want to become rich.

Use your time wisely.

Develop and maintain good habits.

Have a strong work ethic.

Get other people working for you or get your money working for you.

Be careful about debt.

That is how the rich become rich.