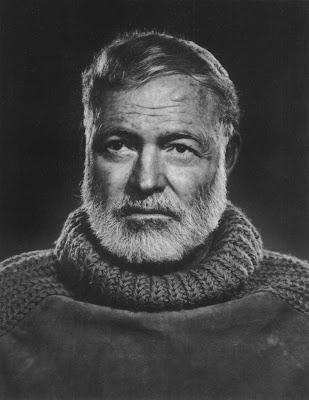

I came across this quote from Ernest Hemingway last week. It seems especially appropriate considering what is going on in Washington, D.C. of late.

Ben Bernanke says the Federal Reserve will not taper its money printing anytime soon. The sad truth is that we seem to be as incapable of kicking the QE habit we have developed as a crack addict has in getting off cocaine.

Axel Merk of Merk Investments provides some perspective on just how far the Federal Reserve has gone to try to create "temporary prosperity".

Below is a chart depicting relative growth of central bank balance sheets since August 2008. This growth is often referred to as the amount of money that’s been printed, even if no actual banknotes are issued. When money is “printed” to buy, say $1 billion in Treasuries, the Fed credits the account of, say, Goldman Sachs, with said $1 billion. In return, the Fed’s balance sheet now carries the Treasuries on the asset side, growing by $1 billion, and the $1 billion credit to Goldman on the liability side. In total, the Fed balance sheet now stands at over $3 trillion. On the chart below, tapering refers to the rate at which the growth of the Fed’s balance sheet will level off, i.e. when the black line moves horizontally, rather than upward:

Contrast that with the European Central Bank (ECB) that’s actually mopping up liquidity. It’s not that the ECB is so hawkish, but their printing press is wired differently: instead of buying some seemingly random amount every month, the ECB’s balance sheet is demand driven. That is, when banks request liquidity (cash), the ECB provides it in return for qualifying collateral.

Should it come as a surprise that the euro is the best performing currency year-to-date? Last year, by the way, with all the trouble in the Eurozone, the euro also outperformed the U.S. dollar. That’s how well the cleanest of the dirty shirts has been performing. It seems to me that the seemingly clean shirt has been trading on unrealistic expectations that it might outshine the rest of the laundry.

There are indeed a lot of dirty shirts around the world. Consider these observations from Egon von Greyerz of Matterhorn Asset Management on the mountain of debt that has built up around the world. When you look at the mounting interest costs on that debt you begin to see why the Federal Reserve and other central banks are doing every thing they can to put the lid on interest rates. You also see why inflation is ultimately the last refuge of political and economic opportunists. It literally is the only way out. Ultimately, if the public stands silent, government debts will be paid with currency worth cents on the dollar.

“The G-7 are the top industrialized countries in the world: The U.S., the U.K., France, Italy, Canada, Germany and Japan. Since neither China and Russia are included, you can question the validity of this group, especially since most of the G-7 countries are bankrupt.

Nevertheless, the G-7 represents around 50% of world GDP, which totals $30 trillion. But these countries have a total debt of $140 trillion, which is a remarkable 440% of their GDP. If you look back to 1998, the total debt of the G-7 was $70 trillion and their GDP was $30 trillion. So, Eric, debt has doubled between 1998 and 2012, from $70 trillion to $140 trillion, and GDP has only gone up by $10 trillion. What this means is that it takes $70 trillion of additional debt to produce $10 trillion of additional GDP.

So the world’s so-called richest nations need $7 of debt to produce $1 of GDP. The world is bankrupt, and all of the economic figures that are being published are just a mirage of a castle built on a foundation of worthless paper money. The world can, of course, never pay back the debt with real money, and the world can’t even pay the interest with real money.

Every 1% increase in the interest rate means an additional cost for the G-7 of a staggering $1.4 trillion. That is absolutely massive. $1.4 trillion is only slightly less than the entire GDP of Canada. If interest rates increase by 10%, then we are looking at an increase in interest expense for the G-7 nations which equals the entire GDP of the United States.

Of course, at the same time, we also have a President talking about deploying U.S. military forces in a war effort in Syria that is undefined and ill-conceived. It looks like nothing more than a refuge to cover for Barack Obama's ill-considered remarks, missteps and foreign policy failures.

I read The Old Man and the Sea in the 7th grade. I didn't really realize at the time how well Hemingway could really see. I thought he was just a good writer. I now understand that he was much more talented than I thought.

I read The Old Man and the Sea in the 7th grade. I didn't really realize at the time how well Hemingway could really see. I thought he was just a good writer. I now understand that he was much more talented than I thought.

No comments:

Post a Comment