A few random observations, charts and factoids to provide some context on what is going on in the world.

Climate Change

As we ponder how much stock to place in those who tell us what the climate is going to be 5, 10, 50 or 100 years out, and use it to claim we need to drastically reorder our lives today to avoid catastrophe tomorrow, we might want to consider how accurate various climate predictions have been.

This was the prediction in May for this year's hurricane season in the Atlantic.

What have we seen in hurricane activity thus far this year?

Things can yet change.

However, isn't that the real point?

The climate has always been changing and it will continue whether man is involved or not.

Could it be that climate policy is more dangerous to us than climate change?

Ask that of those in Europe right now.

Mortgage Rates

The 30-year mortgage rate in the United States hit 5.89% last week.

Last year it reached an all-time low of 2.65%.

It is now the highest it has been since November, 2008.

You can see what the combination of higher interest rates and higher home values have done to the average monthly payment of someone looking to buy a home since January, 2021.

January, 2021---$1,294. August, 2022---$2,447

The chart below compares the 30-year mortgage rate (red line), one family houses monthly supply (blue line) and one family houses sold (green line).

Higher interest rates are causing pain in the real estate market.

|

| Credit: https://twitter.com/SylvainBaude/status/1567135018505621505/photo/2 |

I think we can expect even more trouble ahead.

Household Net Worth

The government's Covid relief money and the Fed's accommodative money printing policies boosted the net worth of many households over the last two years.

Household and non-profit organization's net worth grew from $116 trillion at the end of 2019 to $150 trillion at the end of 2021 according to a recent report by the Federal Reserve.

That was a 29% increase in just two years.

Stock market equity gains provided $11 trillion of the $34 trillion of increased net worth.

Mutual funds provided $3 trillion.

Pensions and retirement funds added $3 trillion

Increases in household owners home equity contributed $7 trillion in added net worth.

Though the first six months of the year about $8 trillion of the $34 trillion (approx, 25%) in increased net worth had been erased.

This was almost all centered in losses in the stock market.

None of it in was house values as of the end of the second quarter. Overall house values were still up in the second quarter in the Fed data.

|

| Source: https://www.federalreserve.gov/releases/z1/20220909/html/recent_developments.htm |

Considering the factoids above on mortgage rates and the housing market right now, you have to believe that there is more pain to come especially when you look at how extraordinary the increases in net household net worth were in the space of a mere two years.

What goes up can come down.

Student Loans

When the Covid pandemic hit us the federal government gave those with student loans the ability to seek forbearance on payments of their student loan debt during the emergency.

Of course, this only allowed borrowers the option to not make payments if they were in financial stress.

The debt was still owed and interest continued to accrue.

If you were not in financial stress it made little economic sense to not pay because the debt would just grow larger with the interest continuing to accrue. and compound.

Of course, if someone is telling you that your student debt may be cancelled or forgiven you might stop paying merely because you might believe you are not going to have to pay in the end..

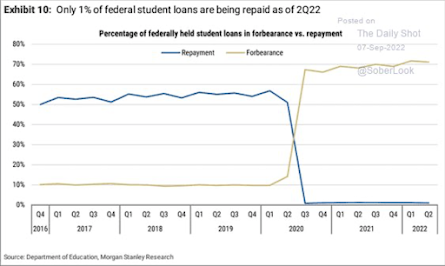

This is an interesting chart that shows that almost anyone holding student debt has not bothered to make any repayments on their student debt in the last two years.

Now that Joe Biden has actually issued an executive order to cancel up to $20,000 of student debt per person you have to wonder whether anyone will ever make a repayment again or pay for college without taking out a loan?

Isn't everyone going to be thinking that the next cancellation of student debt is just another election away?

Vacation Time

In that there are so many problems in the United States and the world it is comforting that Joe Biden is always on the job and laser-focused on what needs to be done.

Never mind.

No comments:

Post a Comment