At one time, housing values, stock market prices and other asset values were driven primarily by more fundamental issues.

Stocks went up principally based on revenue growth and increases in earnings per share.

Housing prices went up based on supply and demand in the geographic area and in relation to construction costs of new housing.

Interest rates have taken on an outsized importance in almost all asset prices, particularly in the last 20 years.

It seems market watchers pay more attention to Federal Reserve policy these days than they do to almost any other factor.

Many under the age of 40 do not know anything about living and investing in a world other than with ultra low interest rates,

Consider this chart of 6 month Treasury bills.

|

| Source: https://www.cnbc.com/quotes/US6M |

To put that rate in further perspective, last year at this time the yield on 6-month Treasuries was 0.66%.

It was easy for the value of stocks to increase when the alternative was putting money in an interest-bearing account or bond that was paying a very low interest rate.

As interest rates rise, stocks become less attractive to investors.

We are heading into a new world with much higher interest rates that will likely have wide ranging effects on asset prices and the economy at large.

Homeowners benefited tremendously as mortgage rates went lower and lower.

The median price of a house in the United States at the end of 2022 was $467,700.

It was $76,000 in 1982.

Higher mortgage rates are already starting to affect the housing market.

Single family home sales in January, 2023 were down 36.1% compared to last year.

Mortgage demand has collapsed.

Fewer people are buying and nobody is refinancing at these rates.

Why is this happening?

Simply stated, at these interest rates, fewer and fewer people can afford to buy a home.

The affordability index is worse now than it was in 2006 during the so-called "housing bubble" that preceded the Great Recession of 2008-2010. That recession was fueled by a drop in housing values in many parts of the country.

|

| Source: https://twitter.com/nickgerli1/status/1628486988268462081 |

This graph shows the effect of higher interest rates on the amount of house someone can afford with a fixed $1,850/monthly payment.

At 2.7% rates, $1,850/month will get someone a $462,000 house.

At current rates (6.9%), that payment will only pay for a $284,000 house.

|

| Source: https://twitter.com/GRomePow/status/1628469848740179968/photo/1 |

Are we reaching a point that something has to give in the housing market?

Interest rates don't affect cash buyers but they only make up 29% of all housing sales.

|

| Source: https://cdn.nar.realtor/sites/default/files/documents/2023-01-realtors-confidence-index-02-21-2023.pdf |

Note as well in the survey highlights above that last year 46% of all properties sold above the list price.

In January, 2023, only 16% sold above list.

This indicates that the housing market is quickly softening in the face of higher interest rates.

We are also seeing consumer loans outstanding increasing rapidly as more and more households feel the effect of inflation.

The cost squeeze on households is also apparent in looking at the plummeting personal savings rate.

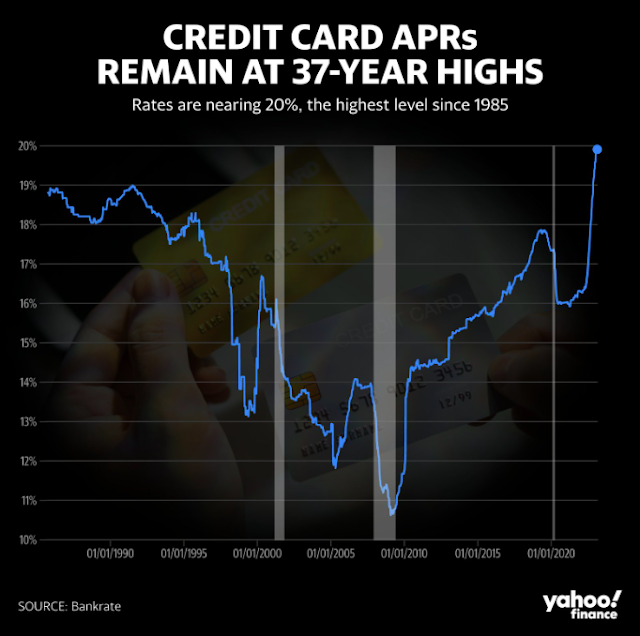

At the same time that credit card balances are exploding, the average interest rates on those credit cards have reached the highest levels ever.

Average rates on cards are 20%.

|

| Source: https://finance.yahoo.com/news/troubling-signs-emerge-as-credit-card-debt-hits-record-high-160607906.html?ncid=twitter_yfsocialtw_l1gbd0noiom |

At this point, the stock market and employment have held up reasonably well as interest rates have risen.

The S&P 500 is actually up by about 5% in 2023 thus far.

Can this continue in the face of the interest rate environment?

Inflation has not come down as quickly as many economists believed it would.

In fact, the month to month increase in January of .5% was the highest it has been in the last seven months (tied with October).

|

| Source: https://www.bls.gov/news.release/cpi.nr0.htm |

The Federal Reserve has indicated that it will not stop increasing the Fed Funds rate until inflation looks like it is heading to the 2% policy target.

Most observers believed that we would not see any further 50 basis point increases by the Fed.

That is no longer the case.

We are at a point that it is all about interest rates now.

How high will they go?

Can the economy withstand the shock of those increases in interest rates?

It is always the goal of the Fed that when things get overheated it is attempting to bring the economy and inflation down with a soft landing by increasing interest rates.

Bringing inflation down with a soft landing will not be easy.

A lot of easy money was made with low interest rates.

Everything gets much harder when they go the other way.

The question is how hard will it get and how hard the landing is going to be?

No comments:

Post a Comment