There seem to be a lot of flashing red signals on the economy lately.

First Republic Bank

First Republic Bank is the latest bank to fail. It was recently the 14th largest bank in the United States.

Its stock was priced at $122.50 share on March 1. It closed Friday at $3.51.

Shareholders have lost $30 billion in this stock over the last year.

|

| Credit: https://twitter.com/WatcherGuru/status/1651998785898262535/photo/1 |

Just over a month ago a consortium of 11 banks deposited $30 billion into First Republic to prop ii up in the aftermath of the Silicon Valley Bank failure.

Despite that fact, First Republic still saw a decline in its deposits of massive proportions in the first quarter that continued through April.

Deposits in the first quarter alone decreased 36% from year-end.

All banks are seeing outflows of deposits as money tends to go where it is treated best. The reality is that bank deposit rates are just not competitive with money market funds and treasury securities right now.

$5 trillion in deposits have been withdrawn from banks in the last 12 months. This has disproportionately affected regional banks like First Republic this year in the aftermath of the Silicon Valley Bank failure.

First Republic's problems are a direct result of rising interest rates and poor risk management controls. It has many large, low jumbo fixed rate mortgages and treasury securities on its books matched against large deposits (over half over the FDIC limit of $250,000).

As interest rates have risen its assets lost more and more value.

At the same time, as interest rates rose depositors began withdrawing their money and bought T-bills or put the money in money market funds to avoid the minuscule interest First Republic was paying on its deposits.

Each withdrawal made First Republic weaker and resulted in more withdrawals. It ultimately becomes a self-fulfilling prophecy.

What was First Republic focused on rather than its financial risk management situation?

It was busy virtue signaling on what a good, good bank it was to those West Coast liberals that made up a large proportion of their deposit and customer base.

|

| Credit: https://twitter.com/US_OGA/status/1652311879295938563/photo/1 |

I would also say that you have to appreciate Elon Musk's humor at times like these.

Commercial Real Estate

A big problem for banks that is going to get more and more attention are their loans on commercial real estate in large cities.

Values on these properties are dropping as occupancy rates decline and vacancies increase.

This is true for both office buildings and retail.

Banks that have large loans in this sector are undoubtedly going to feel pain.

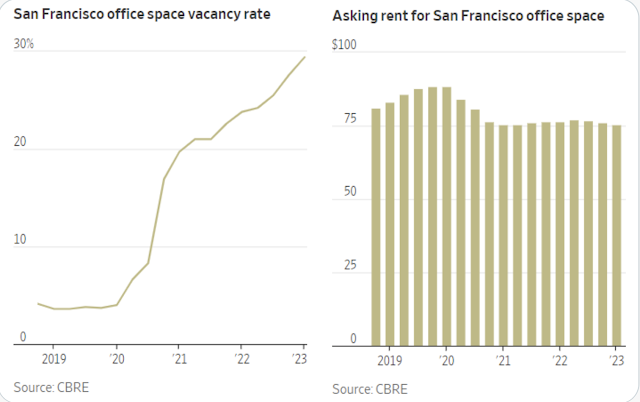

For example, The Wall Street Journal recently reported that the office vacancy rate in downtown San Francisco is at 30%. One office building that was valued at $300 million before the pandemic is now only worth about $60 million.

|

| Source: https://www.wsj.com/articles/san-francisco-commercial-real-estate-office-buildings-471742ea?mod=djem10point |

|

| Credit: https://twitter.com/charliebilello/status/1651793360976265218 |

Why are we seeing this?

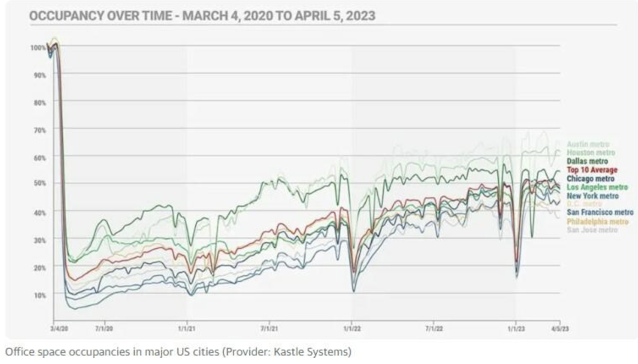

Despite the fact that we are three years beyond the beginning of the pandemic, offices in most major cities only have about 50% of the occupancy by employees they once did.

This chart shows the story.

If employees are not coming into the office the employer does not need as much office space at the next lease renewal.

You can also see what is going on in many cities by looking at cell phone traffic.

Cell phone activity in San Francisco is at 31% of pre-pandemic levels. In Portland it is at 37%.

In Salt Lake City it is at 135% of pre-pandemic levels. In Fresno it is at 121%.

Being the landlord or lender of real estate in cities like San Francisco looks to be a risky proposition right now.

Corrugated Container Shipments

My father was in the corrugated container business.

He always told me that his business was an excellent signal to look at insofar as the overall economy was concerned.

When the economy was good he sold at lot of boxes. When it was bad sales dropped in sync.

|

| Credit: https://gbepackaging.com/Category/boxes-corrugated-40225 |

Considering what my father told me I was interested to see this recent chart regarding box shipments made by Packaging Corporation of America which is a major supplier in this sector.

Was my father right?

It looks like another flashing red signal.

Money Supply

This is not a very good signal either.

Money supply has contracted year over year for the first time in 90 years.

Yes, we are coming off of a gigantic increase in the money supply due to the money printing at the Fed.

However, the other four times over the last 150 years there was a contraction in the money supply we ended up in tough economic times.

|

| Credit: https://twitter.com/nickgerli1/status/1650927931126849548 |

All of the previous times we saw the money supply contract like this there were bank failures and unemployment rates that reached 10%.

Will history repeat in a Fourth Turning?

Labor Unrest in the UK

In the 1970's it seemed that there was always some type of labor strike occurring in the UK that was reported in the U.S news.

This has been rare in recent years.

However, the tide has turned as inflation has squeezed every worker's pay.

This is a stunning chart.

Can you say labor unrest?

|

| Credit: https://twitter.com/jessefelder/status/1650626132813955072 |

Almost 25% of workers in the U.K. are unionized compared to less than 10% in the United States.

This is one reason we have not seen a similar number of strikes in the U.S.

UK households also have had to deal with much higher energy price hikes than the U.S.

|

| Increases in Prices of Electricity in UK Source: https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/czcz/mm23 |

Household Surveys on Economy

Fox News poll indicates that 70% of registered voters currently believe that it feels the economy is getting worse for their family.

This is highest negative score since this question was first asked in this poll.

Only 21% rate the economy Excellent/Good in the same poll. 78% say it is Fair/Poor.

75% if respondents in a recent Gallup survey believe that economic conditions are getting worse right now.

That number was 46% in 2021 shortly after Joe Biden took office.

Signals are flashing red almost everywhere you look right now.

Plan accordingly.

Re "Will history repeat in a Fourth Turning?"

ReplyDeleteThe idea of a 'Fourth Turning' is a whitewash of reality, of history. Similar to Desmet's book on "mass formation" and many other works...

The misleading false idea/lie/fantasy both these authors present is that the psychotic "negative developments" are just TEMPORARY crises or phases before humans return to a lasting state of non-craziness and normality. In addition, the author of the 'Fourth Turning' claims that near the end of the fourth turning sociopaths rule enslaving the public (=the problem is the criminal authorities, the public is a victim).

These are of course welcoming narratives so they are and become popular, pandering to the masses' love for fantasies about reality and reinforcing their lunacy.

The true human history, however, is a history of CHRONIC craziness going on for aeons with "civilized" people, and the true reality is there are TWO human pink elephants in the room ... and they are MARRIED and NEITHER is innocent:

https://www.rolf-hefti.com/covid-19-coronavirus.html

It's why Hegel noted people have never learnt anything from history.

The ruling gang of criminals pulled of the Covid Scam globally via its WHO institution because almost all nations belong to it. If you're in the US go to https://sovereigntycoalition.org and sign the American Sovereignty Declaration to #ExitTheWHO and follow their prompts to contact your representatives and tell them to work for their constituents instead of the mega psychopaths in power.