The amount of federal debt of the U.S. government continues to grow.

It is now over $35 trillion. It is up over $12 trillion since 2020.

|

| Source: https://x.com/KobeissiLetter/status/1818050246242365893 |

Federal debt as a % of GDP is now higher than what it was right after we borrowed heavily to fight and win World War II.

At the end of 2023, U.S. debt was 121% of GDP.

It peaked at 119% in 1946.

|

| Source: https://fred.stlouisfed.org/series/GFDGDPA188S |

The debt taken on for World War II became manageable over time because the economies of most countries around the world were devastated by the war. This allowed the United States to dominate the world economy with large annual increases in GDP.

We are in a much different position today.

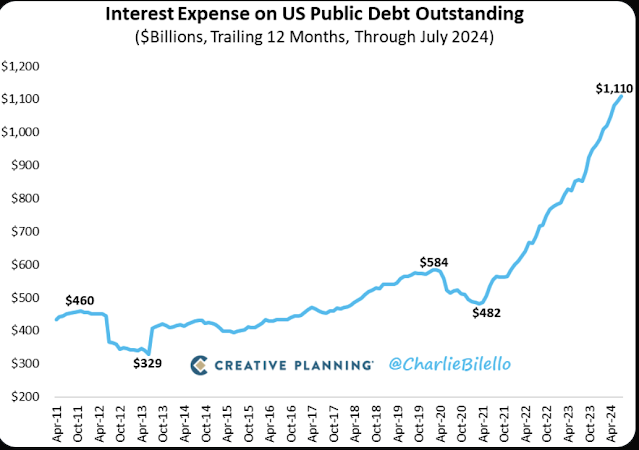

Interest expense on the federal debt is now over $1.1 trillion per year.

To put that number in context, it is estimated that the United States will only collect $1.7 trillion in individual income taxes in 2024!

In August, the federal government spent twice as much as what came in from revenues.

$307 billion in receipts. $687 billion in outlays.

Interest expense is now consuming almost 65% of every dollar of individual income taxes coming in.

Net interest (Interest expense minus interest income) is now the second largest outlay in the federal budget.

As the debt continues to increase and interest payments get larger, more and more pressure will be exerted on the federal budget.

The interest paid to service the debt will begin to squeeze out all other spending. Do you see a problem?

The recent 50 basis point cut in interest rates had little to do with the economy. It was not justified in any way by economic data. The stock market is at all-time highs. Inflation has trended down but is still not at the 2% Fed target. The unemployment rate is 4.2%.

The Fed move is all about making it cheaper for the federal government to finance its debt most of which is now being issued in short-term maturities which the Fed rate influences a lot more than longer debt terms.

In 2023, the Treasury issued $23 trillion in Treasury bills (less than 12 months maturity). This was to cover $2 trillion in deficit spending and refinance debt that was maturing and had to be financed. It was done because not many are willing to buy longer-term notes and the Treasury was betting (hoping?) that short term rates would come down in the future when these bills came due.

The can is being kicked down the road and it is critical for the Treasury to have lower interest rates.

Jerome Powell is making sure that hope comes true.

We are on track to have a $2 trillion budget deficit for the 2024 fiscal year and there is no sign that this will get better in the near future.

In fact, a full fledged recession would result in the deficit exploding much higher.

We are being buried under a mountain of debt.

There is a common misconception that I often hear from people about who owns all of the debt of the U.S. federal government.

Many think that China and other foreign entities hold a lot of it.

The fact is that almost 75% of the U.S. debt is held domestically.

The largest holder of the U.S. debt is, in fact, the federal government itself. This is debt held in intragovernment accounts such as the Social Security or Medicare trust fund accounts. $7 trillion of the debt is held in these accounts of which Social Security ($2.6 trillion) and the Federal Employees Retirement Fund are the largest ($1.1 trillion).

This debt has accrued as the federal government collected taxes previously for things like Social Security benefits. As FICA taxes were paid while baby boomers were working, this money was first used to pay the benefits of their parents. However, the amounts collected in taxes were much larger than necessary to pay the benefits of the older generation.

The excess was not locked away but spent on current needs (defense, welfare, etc) and an IOU was given by the federal government to Social Security. That debt is now coming due and it can only be satisfied by new taxes coming in or issuing new debt.

Do you see a problem?

In 2024, Social Security benefits will exceed payroll tax contributions by $152 billion. These benefits are effectively being paid through the issuance of new external debt. By 2035, the "trust fund" reserves will be completely depleted. At that point revenues are projected to only cover 83% of benefits payments. In future years it will be reduced to 73%,

The second largest holder of treasury debt is the Federal Reserve System. It holds over $5 trillion of debt. This is a result of effectively printing the money and then "loaning" it to the federal government.

Other domestic owners (mutual funds, banks, pension funds, insurance companies, individuals) hold $14 trillion of the debt.

The largest country for foreign ownership of U.S. debt is Japan with $1.1 trillion.

China is second with $800 billion and the U.K. third at $700 million.

China has also reduced its ownership of Treasury debt by over a third in the last decade.

This is the distribution of the holders of U.S. Treasury debt as of the end of 2023.

|

| Credit: https://san.com/cc/the-us-breached-34-trillion-in-national-debt-heres-who-owns-every-dime/ |

Here is a breakdown of the foreign holders of U.S. debt.

|

| Credit: Credit: https://san.com/cc/the-us-breached-34-trillion-in-national-debt-heres-who-owns-every-dime/ |

The reality is that the United States actually has relied less on foreigners to buy our debt than most other developed countries.

As shown in the chart below, only Japan, Sweden and Switzerland have less government debt held by foreign entities.

|

| Credit: https://x.com/ISABELNET_SA/status/1824391739789963541 |

All of this says that the United States is being buried under a mountain of debt.

That mountain of debt is just going to get bigger and bigger with each succeeding year due to the compounding of interest on the debt

Even with an average interest rate on the debt of 3% the federal debt will be $47.5 trillion in 10 years if the federal government started running a balanced budget next year.

Sustained $2 trillion annual deficits on top of that debt will mean the United States will be looking at $70 trillion in debt by 2034.

It does not matter if Kamala Harris or Donald Trump is elected President.

A day of reckoning is approaching.

The reality is that no matter how much Kamala wants to raise taxes on the rich there is not enough money to make a small dent in the numbers. We also know that any money Kamala might receive from new taxes will immediately be spent on new handouts.

Likewise, as far as Trump is concerned, not taxing tips, overtime pay or Social Security benefits is not likely to result in enough economic growth to pay for those cuts and have enough left over to solve the debt problem.

We are going to see a debt crisis sooner or later.

The numbers don't lie.

It is another reason that I believe that Donald Trump is the only realistic vote for President.

Trump has been a problem solver in business his whole life.

He also has a lot of experience in dealing with highly leveraged debt situations.

Kamala Harris does not have a clue. She has never done anything in business or the private sector. She has no problem solving experience.

She is also beholden to Wall Street for a lot of her campaign donations.

|

| Source: https://fortune.com/2024/07/24/wall-street-kamala-harris-campaign-fundraising-presidential-election/ |

Does anyone remember what happened in the 2008/2009 financial crisis?

Wall Street got bailed out. Main Street paid the price for it.

Donald Trump gives Main Street a fighting chance if that day of financial reckoning comes during the next four years.

Trump knows that the only real choice we have to get out from under the mountain of debt, without doing great financial damage to most Americans, is economic growth similar to what the United States was able to do after World War II.

Barring that, the debt will only become manageable through default (unlikely but not impossible, especially if the U.S. dollar loses its reserve currency status) or massive inflation that will allow the debt to ultimately be paid off with cents on the dollar. Either of these will result in financial ruin for most Americans.

The numbers are sobering.

However, the math does not lie.

Who is the most capable and has the past business experience to being sitting in the desk in the White House managing that mountain of debt?

Another reason to choose wisely in 2024.

No comments:

Post a Comment