Since he arrived on the political scene the Democrats have called Donald Trump a "threat to democracy".

This is despite the fact he has won two Presidential elections (and possibly a third) proving that his agenda is supported by the American people.

It is also true that Trump is the most transparent President that we have had in my lifetime.

As I have written before in these pages, Trump has governed exactly like he ran. There was no bait and switch. That was true in his first term and it is no different in his second term

He did not run saying one thing and then do something else as President. He does what he says he is going to do.

This is very upsetting to Democrats.

They were on the streets several weeks ago with their "No Kings" protest asserting that Trump was acting as an authoritarian king.

The complaints of the protestors about Trump seem to center on the fact that as President he is following an agenda that is totally consistent with the platform he ran on---closing the border, mass deportations of illegals, tariffs, extension of the Trump tax cuts, DOGE, etc---and won the election with a majority of the electoral and popular vote.

The Democrats have gone to the courts innumerable times to get liberal judges to issue nationwide injunctions against Trump's executive orders.

40 nationwide injunctions were issued against the Trump administration in the first four months of his second term.

In fact, an astonishing 67% of all nationwide injunctions issued by the courts against any Presidential administration in the history of the United States have been directed at Trump according to Jay Sekulow with the American Center for Law and Justice.

Trump challenged the use of these nationwide injunctions earlier this year in a case that went to the U.S. Supreme Court involving birthright citizenship.

Trump argued that allowing an unelected federal judge to enjoin the authority of the executive branch exceed the constitutional and equitable authority of federal district courts.

Allowing a single district judge to halt executive actions across the entire country would effectively allow the judicial branch to make policy decisions that belong to the executive branch.

In a 6-3 decision that was handed down on Friday, the Supreme Court ruled that federal courts do not have the authority to prohibit enforcement of federal laws of executive orders on a nationwide basis.

The authority of the court only extends to the person filing the action for injunctive relief.

Justice Amy Coney Barrett wrote the majority opinion which did not directly rule on the question of birthright citizenship.

The three liberal women justices---Kagan, Sotomayor and Jackson dissented from the ruling.

Justice Barrett was particularly harsh in smacking down the dissent of Jackson to the majority ruling.

She observed that Jackson's argument was at odds with 200 years of precedent as well as the Constitution itself. Jackson also railed on about an imperial Presidency but seems to have no problem with an imperial Judiciary.

|

| Credit: https://x.com/ArtemisConsort/status/1938664081830924331 |

It is also interesting to note that Justice Kagan, who voted to allow nationwide injunction of executive orders, had a completely different view of the issue thee years ago.

In 2022 Kagan said that it can't be right that one judge can stop nationwide policy.

|

| Link: https://x.com/RealJamesWoods/status/1939042286454874123 |

What changed?

Biden was President in 2022. Trump is President in 2025.

Is this how the Constitution is supposed to be interpreted?

Politics comes before the letter of the law?

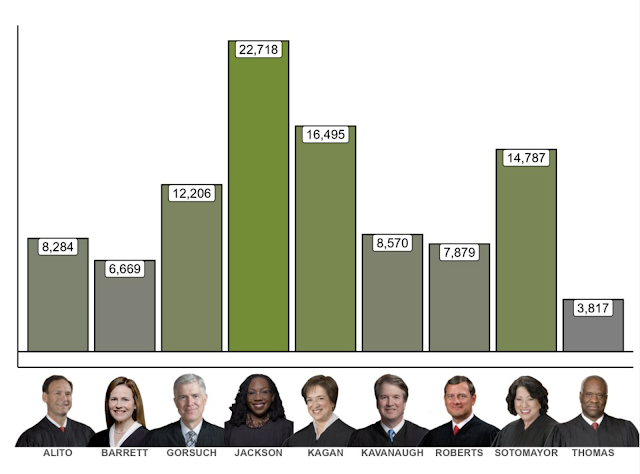

Another interesting side note is how much the three liberal female justices like to dominate the floor when oral arguments are being heard.

These stats are for 2024 (thru November 15) and compare the number of words each Justice spoke during oral arguments.

The three liberal women spoke more than the other six justices combined by a comfortable margin.

You have to wonder with all the talking they are not listening and thinking enough about the law.

Jackson, is by far, the very worst.

|

| Credit: https://x.com/doc_gero/status/1938660287072424442 |

Of course, it has been most interesting seeing liberal Democrats melt down after the Supreme Court ruling was handed down.

I have again heard that Donald Trump is a "threat to democracy" and that the Supreme Court is endorsing "lawlessness".

Of course, the same liberals have told us repeatedly that a Supreme Court decision is the "law of the land" when it came to abortion rights or gay marriage.

I have heard that this ruling now puts the country in existential crisis because Congress is not willing to restrain Trump and lower courts now have no power to do so.

It does not seem that left wingers understand the definition of democracy.

Trump was elected to do the things he is doing.

In fact, a recent Pew Research poll shows that Trump would have still won even if all those who did not vote had turned out. In fact, Pew says the margin would have been even larger.

|

| Source: https://www.npr.org/2025/06/26/nx-s1-5447450/trump-2024-election-non-voters-coalition |

Majorities in the Senate and House were also elected largely based on Trump's agenda.

That is democracy.

The people voted and made their choice clear.

Vice President Vance does a good job of trolling the left wingers over on BlueSky which is the Left's competition to Twitter/X.

What is it that they don't understand about democracy?

The Democrats lost.

Trump and the Republicans won.

It is 2025, not 2022.

It does seem that Democracy is winning.