The class warfare agenda begins with proposals to tax the "rich".

Who is "rich"?

Is it the top .1% of income earners? The top 1%? The top 10%? The top 50%?

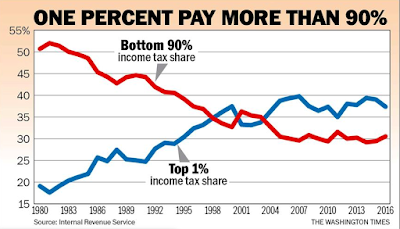

As it is, the top 1% already pay more in federal income taxes than the bottom 90% and their share of the tax burden has increased dramatically since 1980.

Elizabeth Warren does not even want to limit taxation to income alone anymore.

She is proposing a tax on an individual's wealth or net worth.

I can say, with some experience having practiced as both a tax attorney and CPA, that this proposal would be a nightmare to administer and is tailor-made for manipulation and gaming of the system. It would also undoubtedly result in massive unintended consequences. Whenever the rich are targeted the result is that the little guy usually takes the biggest hit.

I am still old enough to remember when President George H.W. Bush (breaking his "no new taxes" pledge) and the Democrats put a luxury tax into effect as part of a deficit reduction compromise package in 1991.

This tax was levied on material goods such as watches, expensive furs, boats, yachts, private jet planes, jewelry and expensive cars. Congress enacted a 10 percent luxury surcharge tax on boats over $100,000, cars over $30,000, aircraft over $250,000, and furs and jewelry over $10,000. The federal government estimated that it would raise $9 billion in excess revenues over the following five-year period.

The law was repealed less than two years later as thousands of workers lost their jobs in these industries.

The little revenue that was raised was more than offset by the taxes that disappeared as a result of the lost wages and the unemployment benefits that had to be paid to the workers who paid the price with their jobs.

The great economist Walter E.Williams explains why unintended consequences are so common when the "rich" are targeted in these tax raising schemes.

Congress repealed the luxury tax in 1993 after realizing it was a job killer and raised little net revenue. Why did congressional dreams of greater revenues turn into a nightmare? Kennedy, Mitchell and their congressional colleagues simply assumed that the rich would act the same after the imposition of the luxury tax as they did before and that the only difference would be more money in the government's coffers. Like most politicians then and now, they had what economists call a zero-elasticity vision of the world, a fancy way of saying they believed that people do not respond to price changes. People always respond to price changes. The only debatable issue is how much and over what period.

Why don't politicians learn from past mistakes?

A big reason is that it is so easy to play to people's envy and everyone's natural inclination to be more than willing to have someone else picking up the tab.

Senator Russell Long (D-LA) who was Chairman of the U.S. Senate Finance Committee from 1966 to 1981 probably said it best.

Don’t tax you,

Don’t tax me,

Tax that fellow behind the tree.

Or course, we almost always believe that everyone else is in a better position to pay than we are.

The chart below compares how people perceive their relative income compared to reality. This study was done in Sweden but I have no doubt it is also true for other countries (including the U.S.)

As you can see, there is a pretty consistent pattern of people believing that they are less well off than they really are (data points below the line). This is particularly true for those in the 40th to 100th percentiles.

Note that even the richest (those in the upper 1% or .1%) don't believe they are as rich as they are. Someone is always better off. I guess even Jeff Bezos and Bill Gates even feel that way.

|

| Credit: Twitter @JohhHolbein1 https://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00623?journalCode=rest |

Some might argue it is curious that those in the lower percentiles (25th percentile and lower) actually believe they are doing better than the facts support. My guess is that this is due to government provided social spending that provides benefits (housing, food etc) but is not considered "income".

As a result, people with less income actually feel better about their positions than others with higher incomes because of the additional social support. Keep in mind that those in higher income categories are also bearing a great deal more in taxes which lowers their disposable income.

All of this just goes to show that everything in life is relative. If you are earning $1 million per year and living on the Upper East Side of Manhattan you probably consider yourself poor compared to your neighbors. On the other hand, my father was very poor growing up in Sandusky, Ohio in the Depression but he told me he never felt poor because everyone he knew was in the same situation.

It all depends on your perspective. For example, if you live in the United States and you earn more than $32,400 annually you are in the top 1% of income earners in the world. Keep in mind that the world is also far more prosperous than it ever has been as well. Those who earn $32,400 or more today undoubtedly are in the top .1% of those who ever toiled upon the earth.

Keep all of this perspective in mind as you hear those calls to "tax the rich" and "make them pay their fair share".

You might also want to check your own perspective and see how accurate it is compared to reality by going to this website.

It allows you to see how you compare to other households and to also compare what you believe a perfect world to be on the distribution of income compared to what it really is.

Could it be that a few Democrats might find themselves Republicans (and vice versa) when they compare their perceptions with reality?

I doubt any of this will affect any of the Democrats running for President. After all, the only currency they are concerned with is collecting votes. You can be sure that playing class warfare is the easiest way to do that when it comes to Democrat primary voters.

Elizabeth Warren is not going to stop at merely taxing the rich in her quest for those votes. Warren and several other Democrats (including Kamala Harris) are also out there stating that they believe that reparations should be paid for black Americans affected by slavery.

Never mind that slavery has not been in existence in the United States for over 150 years. Anyone today is probably at least five or six generations removed from having anything to do with slavery. How does any of this make sense?

Predictably, it does if someone is going to give you the money. It doesn't if someone is going to take money from you to give to someone else.

The Democrat message in 2020?

Give the money to ME.

Take it from the person who is behind the TREE.

It doesn't matter if they planted the tree. Watered it. Nurtured it. Pruned it and cared for it over many years. Cut it down and give the proceeds to ME! Social justice demands it.

Our constitutional republic was designed to prevent the political pandering we will see over the next two years. We can only hope that it stands the test of time once again.

If not, you don't want to be the person behind the tree. In fact, you don't want to be anywhere near the trees when you have politicians running who can't see the forest from those trees.

No comments:

Post a Comment