The new Democrat nominee for Mayor of New York City Zohran Mamdani wants to solve the "equality" problem he sees by providing free public transit, child care and operating city-owned groceries while increasing taxes on "the rich" to pay for it.

In fact, he does not think that billionaires have a right to exist.

|

| Link: https://x.com/DefiantLs/status/1939668780923187575 |

At the same time, Democrats in the U.S. Congress are decrying the extension of the Trump tax cuts in the Big Beautiful Bill claiming that "the rich" are not paying their fair share.

Who decides what is fair?

Let's look at the IRS statistics for the 2021 tax year (the most recent year of data) to put this issue in context.

The top 1% of income earners pay 46% of the income tax burden.

The top 5% pay 66%.

Both groups pay significantly more than their share of income.

The top 1% account for 26% of all the income earned but they pay 46% of the tax paid.

Everyone other group below the top 5% pays less than their share of income earned.

|

| Source: IRS Statistics on Income-2021 |

The top 0.1% actually pays 25% of the income tax burden just by themselves.

Incredibly, the top 0.1% pay more in income taxes than the entire bottom 90%----25.3% of total tax collections vs. 22.5% for the bottom 90%.

|

| Credit: https://x.com/fentasyl/status/1935811712286134350 |

One of the reasons for this is by the increasing use of income tax credits (child care, etc) for those in lower income brackets some of which are refundable even if there is no liability for income tax.

Many Americans no longer pay any income tax----they actually get tax refunds even though they owe no taxes at all.

Refundable tax credits totaled almost $150 billion in 2021.

You could almost call this IRS Welfare.

|

| Credit: https://x.com/fentasyl/status/1936084531108302889 |

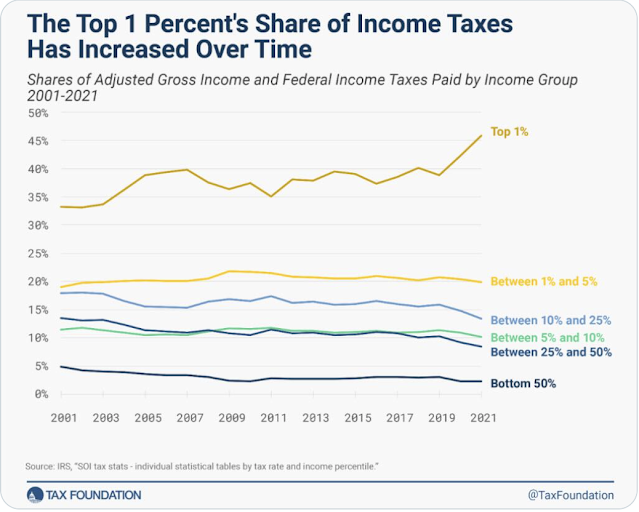

The share of total income tax that the top 1% is paying has also gone up over time.

In fact, it was after the Trump tax cuts that took effect in 2018 that it increased most dramatically.

Keep this in mind as you hear the narrative that Trump massively cut the tax burden of "the rich".

It was the middle class that received the most benefits from the Trump tax cuts that is also apparent by looking at this graphic.

The centerpiece of the Big, Beautiful Bill that is before Congress right now involves the extension of the Trump tax cuts.

They currently expire at the end of this year.

Democrats argue that the BBB will add enormous amounts to the deficit.

However, that is only true if you assume the Trump tax cuts will expire and everyone's taxes go up next year.

If the BBB is not passed, taxes will go up by over $4 trillion over the next 10 years compared to where we are today.

Conversely, the reality is that the BBB will actually reduce the projected budget deficits by about $500 billion in the next 10 years compared to current projections.

This is roughly estimated as about $1 trillion in spending restraint offset by $500 billion in costs for the new tax breaks in the bill for no tax on tips, overtime and the new senior citizen tax deduction.

The spending restraint is largely focused on Medicaid reforms that were once considered mainstream policies---illegal immigrants should not get Medicaid benefits nor should able-bodied people who are able to work.

Let's put all of this in further context.

It is currently projected that the federal government will spend $87 trillion over the next 10 years based on the provisions of current law.

$1 trillion in spending restraint on $87 billion in spending is about a 1.1% decrease in total federal spending over the next 10 years compared to projections.

It should also be kept in mind that the federal government is looking at $2 trillion annual deficits for as far as the eye can see based on current law and policies.

The bottom line is that no one wants their taxes go up.

And anyone receiving federal dollars does not want those dollars to be reduced.

For example, here is one of the New York 1% asking why she doesn't get her money back for the health insurance she pays if she doesn't go to the hospital in a whole year.

Based on that logic, I could also ask why I did not get my money back on my home and auto insurance because my house did not burn down and I did not wreck my car for a whole year.

Whoopi Goldberg is a woman who has a platform she uses every day to promote liberal and socialist policies who obviously does not have the slightest idea about how the most basic social model works.

|

| Link: https://x.com/ThomasSowell/status/1939350647431970950 |

Who decides what is fair?

That is an eternal question.

And fairness seems to always be decided in the eye of the beholder.

Enjoy the fantasy while it lasts.

However, there is absolutely no political will to do what is necessary right now.

Elon Musk did a great service with his DOGE efforts but when the most basic examples of fraud, waste and abuse cannot get majority support in Congress it is time to move on.

At some point reality will force some very tough questions on the political class.

And when that day comes the solutions will not be fair to anybody.

No comments:

Post a Comment