A sampling of interesting facts to provide context to the issues of the day with particular focus on inflation.

Inflation and Interest Rates

The latest published inflation rate is 6.2%. This represents the inflation rate over the last 12 months.

The inflation rate for October was 0.9%. That would equate to an annual rate of 10.8%.

The 6.2% annual rate is the highest rate since November, 1990.

|

| Source: https://twitter.com/awealthofcs/status/1458876500351066112/photo/1 |

However, in 1990 2-year Treasury bonds were yielding 7.8%.

Today they are yielding 0.4%.

You wonder why house prices and stock prices are going up?

A saver is losing almost 6% per year on their money today in real terms.

A lot of people have concluded that they might as well spend it like there is no tomorrow.

How long can this distorted relationship be sustained?

Rents Through the Roof

If house prices go up rents on apartments will follow.

Rents +17.6% since January 1.

Gas at the Pump Soaring

Gasoline at the pump has gone from an average of $2.10 per gallon a year ago to $3.42 today (+63%).

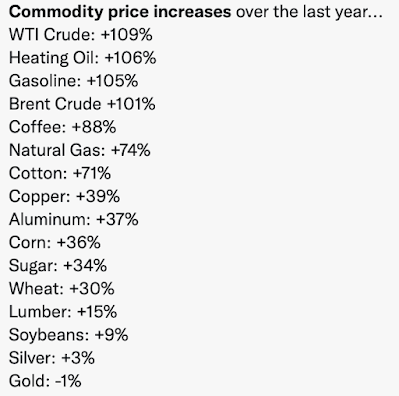

And Almost Every Other Commodity Is Seeing Price Increases

|

| Source: https://twitter.com/charliebilello/status/1458441345824067590 |

Average Change in New Car Prices

It is just not the prices of houses and stocks that are rising along with food, gasoline and everything else.

The average price of a new car is up 9.2% over the last year.Average price is now almost $43,000.

|

| Source: https://twitter.com/LizAnnSonders/status/1458041509467590658/photo/1 |

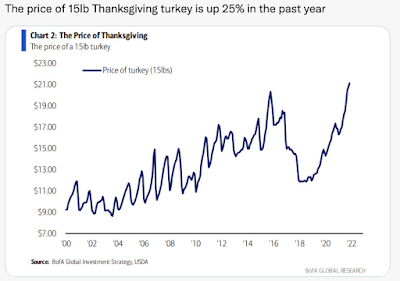

The Thanksgiving Turkey Is No Exception

25% higher this year than in 2020.

Source: https://twitter.com/zerohedge/status/1459279104772124673

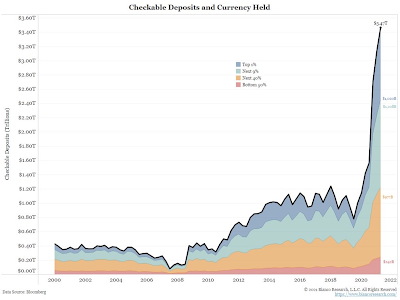

The Fuel That Is Powering Inflation

What is behind the run-up in prices?

You might consider the amount of money that has been printed and distributed over the last two years that is now sitting as checking deposits and currency held..

|

| Source: https://twitter.com/LizAnnSonders/status/1457676731586863112/photo/1 |

Checkable deposits have gone from $800 billion to $3.5 trillion since 3Q, 2019.

However, the Democrats want to print more money?

Consumer Sentiment Is Turning Negative

Consumer sentiment is becoming more negative than it has in over a decade.

This has become particularly apparent in home buyer and car buyer sentiment where the soaring prices seem to be turning off more and more buyers.

Is this a precursor to a drop in demand in coming months that could lead to a recession caused by lagging demand due to the rapid increase in prices that causes more and more consumers to sit it out?

|

| Source: https://twitter.com/SuburbanDrone/status/1454837895781621768/photo/1 |

Confidence We Are Heading In The Right Direction Is Missing

The most recent Real Clear Politics poll average finds that fewer than 30% of Americans believe we are heading in the right direction.

Lack of confidence in the future typically means that people are less willing to invest, open new businesses and do those things necessary to fuel economic expansion.

Another warning sign?

Inflation Taking Away All Wage Growth

Wages are up 4.9% over the last year but with 6.2% inflation the average person is worse off.

In the last month, wages were up +.4% but inflation was up .9%. Real wages fell .5% in just the last month and 1.5% over the last year.

Source: https://www.cnbc.com/2021/11/10/inflation-has-taken-away-all-the-wage-gains-for-workers-and-then-some.html

The media liked to tell everyone how bad things were during the Trump years.

It doesn't look so bad right now.

What Do People Want Joe Biden To Do About All Of This?

There is a lot of bad news on a number of fronts right now.

What do the American people think is most important for Joe Biden to do over the next year?

That question was asked in the recent USA Today/Suffolk poll that I referenced in these pages last week.

More people think it is more important that he should resign, retire or quit than any other single thing he could do!

That says a lot.

All of the above is also is a sober reminder of how quickly things have become undone during the last year.

No comments:

Post a Comment