The U.S. House of Representatives passed Joe Biden's "Build Back Better" bill by a vote of 220-213 last Friday.

Every vote for the bill was from a Democrat.

The 213 no votes included every Republican in the House and one Democrat, Rep. Jared Golden of Maine.

So much for the bipartisanship that Joe Biden said he was going to bring to Washington.

I also assume that Rep. Golden should not expect an invitation to Nancy Pelosi's Christmas party this year.

The contents of this bill were first included in what was described as Biden's infrastructure proposal for the country.

It seems that funding "infrastructure" must poll well when voter preferences are surveyed.

When it was pointed out that spending money on child care credits, free college, housing and health care subsidies did not meet the definition of what most people considered to be infrastructure, the original proposal was bifurcated into two bills. The provisions that were generally considered to be closer to real infrastructure (roads, bridges etc) were included in a separate $1.2 trillion bill passed both houses of Congress and has been signed in to law.

Although the contents of the remaining elements of the original proposal were almost exclusively meant to expand social spending and the Green New deal agenda of leftist Democrats, it was rebranded as "human infrastructure" before they settled on "Build Back Better".

Even to the end, the branding effort of the Democrats to make the measure appealing to voters is not over.

As the bill moves to the Senate it appears that the bill is going to be championed as legislation that would help "fight inflation" and lower costs for families.

|

| Source: https://www.nbcnews.com/politics/congress/democrats-rebrand-build-back-better-bill-counter-inflation-concerns-n1284001 |

Here is Biden's Treasury Secretary, Janet Yellen, claiming that all of this additional federal spending will be anti-inflationary.

|

| Source: https://www.cnbc.com/2021/10/29/treasury-secretary-yellen-says-spending-bills-will-be-anti-inflationary-lowering-important-costs.html |

This is the same Janet Yellen, the former Federal Reserve Chairman, who said as recently as February, 2020 that the United States was on a "completely unsustainable" debt path.

Since that time Congress has passed about $7 trillion in Covid relief spending combined with the recent infrastructure bill before getting to the "Build Back Better"bill. Janet Yellen apparently hasn't noticed it all.

Build Back Better is also the bill that Joe Biden and the Democrats have spent two months telling the American people would cost nothing.

Bear in mind that Biden said this when the top line cost of the proposed bill was $3.5 trillion before Democrat Senators Joe Manchin and Kirsten Sinema stated they would not vote for such as high-priced bill in the Senate.

The final top line cost of the bill passed last week was $1.75 trillion.

Does that mean that the bill actually saves us $1.75 trillion now?

Of course, bills like this are always meant to increase federal spending and foster greater dependence on government to supply more and more "needs" of the citizenry.

That requires the federal government to target certain other groups within the nation to pay for what they are promising in order to prevent even more federal debt piling up.

This bill contains a number of provisions that raise revenues by imposing higher taxes on large corporations and high income individuals.

Of course, it is not enough to equal $1.75 trillion dollars. It is never enough. It will never be enough.

That is true even when part of the revenue is supposed to come from stronger enforcement measures by the IRS.

The bill provides an additional $88 billion in funding to the IRS over the next 10 years (an increase in its budget by nearly 70%) that the White House says will produce $400 billion in new revenue. That is the largest single "revenue" source in the bill. That additional spending will allow the IRS payroll to increase by 87,000 employees.

Independent analysts state they will be lucky to garner half of that $400 billion sum from stronger enforcement.

The Congressional Budget Office (the official source) estimates that $88 billion of enforcement costs will only bring in $207 billion. However, projecting revenues from future IRS enforcement is a fool's errand. For that reason, the CBO's official estimates do not include anything coming in from the additional enforcement,

The CBO final estimate is that the bill will add $367 billion to the deficit over the next 10 years. That is a long way from ZERO.

You begin to understand how distorted the IRS enforcement measure is, and the additional impacts it will have on our economy, when you consider this analysis from the Heritage Foundation that puts the numbers in context.

In other words, under the left’s plan, for each additional $1 the IRS receives for enforcement, it may extract an additional $3 from American taxpayers. That’s extremely inefficient.

Imagine if the IRS spent $1 for each $3 of revenue it currently collects. The IRS would consume one-third of the federal budget, well over $1 trillion per year.

By contrast, the IRS now claims it spends, on average, just over $1 per $300 it collects. On the margins, the new enforcement dollars in the House plan would be spent about 99% less efficiently than the IRS’ current budget.

Presumably, the IRS would attract most of the estimated 87,000 new IRS employees from elsewhere in the labor force. It’s hard to justify draining other employers’ talent pool for such bureaucratic waste.

The bloated enforcement apparatus of the IRS would require Americans to deal with more audits, keep even more comprehensive records, spend more on accounting fees, and may make taxpayers hesitant to claim legitimate deductions and credits for fear of triggering an audit.

In an analysis of a similar proposal in the president’s 2022 budget, the Congressional Budget Office stated that audit rates would increase for all taxpayers, not just higher-income taxpayers. The analysis also noted that some audits would likely be directed at taxpayers who are compliant and owe no additional tax.

It is also important to remember that the CBO estimates of the bill's costs do not consider any dynamic revenue or cost effects. What are the secondary and tertiary effects on what the bill does to GDP, economic growth, employment and the like?

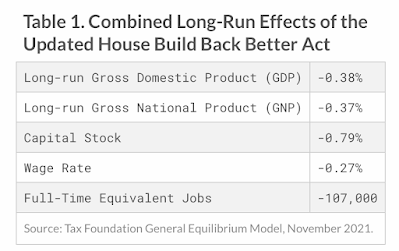

The Tax Foundation has modeled these effects and estimates that if the bill is enacted it would reduce long term GDP, wages and employment.

In other words, this bill does not build---it subtracts.

|

| Credit: https://taxfoundation.org/build-back-better-plan-reconciliation-bill-tax/ |

What are we getting in return for more IRS audits, lower GDP, wages and jobs?

Here are the highlights on where the money is being spent.

Climate Change---$555 billion

Subsidies for everything under the sun that are not fossil fuel related. Subsidies for electric cars, solar panels and "creation of a Civilian Climate Corps that would provide some 300,000 jobs to restore forests and wetlands and guard against the effects of rising temperatures".

There is even $2.5 billion in the bill for "tree equity".

Universal Pre-K and Child Care---$400 billion

Under the universal preschool plan, parents will be able to send their children to a public school or childcare program of their choice.

Families that earn less than $300,000 annually, for instance, will pay no more than 7% of their income on child care for kids under age six, according to the bill.

Child Tax Credits--$200 billion

A one-year extension of the current Covid stimulus program that grants a refundable tax credit paid monthly equal to $300 every month per child under age six and $250 every month per child ages six to 17.

For example, a family with three children, one under six and two over that age, would receive almost $10,000 in cash paid in monthly installments, even if they owed no income taxes. This is already occurring in 2021 due to Covid relief. It will continue for 2022. The Democrats want this to be permanent at $200 billion per year it carries a steep cost.

4 Weeks of Paid Family and Medical Leave--$200 billion

A permanent, comprehensive national paid leave program that gives employed workers—including those who are self-employed—four weeks of paid family and medical leave, which can be used for caregiving or personal illness.

Health Care spending--$165 billion

Primarily increase subsidies for Obamacare plans.

I thought Obamacare was going to make health care more affordable. Why the need for more subsidies?

Expand affordable home care for Seniors--$150 billion

Don't get excited. It is limited to those on Medicaid who have no other assets and are on state waiting lists to get into nursing homes.

Affordable housing subsidies--$150 billion

I guess this is what you need to do when you print money, house prices surge and leave millions of people such that they cannot afford housing.

In a liberal mind all of these are wonderful things to provide. They seem to think the government should pay for everything anyone needs. Housing. Food. Child Care. Education. Healthcare.

However, we are talking about a nation that is already $29 trillion in debt.

That is equal to about $230,000 per taxpayer.

How much can we pile on top of the wagon that those taxpayers are pulling until it breaks down totally?

What is interesting that in a bill that is supposed to "make the rich pay their fair share" the second largest cost in the bill is an increase in the state and local tax deduction limit from $10,000 per year to $80,000 over the next five years.

This is from a Washington Post story on the so-called SALT provision.

It’s the second-most expensive item in the legislation over the next five years, more costly than establishing a paid family and medical leave program, and nearly twice as expensive as funding home-medical services for the elderly and disabled, according to an analysis by the Committee for a Responsible Federal Budget.

This provision provides the average taxpayer with a $20 per year benefit according to an analysis by the Committee for a Responsible Budget. For the average household making $1 million per year, this provision would mean a tax cut of $25,900 according to the analysis. 70% of the benefit would go to taxpayers in the top 5% of earners.

The SALT provision was required in the bill because Democrats in high tax states such as New York, New Jersey and California demanded its inclusion or they would not vote for the bill.

They defend the provision because they say not allowing the state and local deductions result in unfair double-taxation.“Since it was implemented in the 2017 Republican tax hike bill, the cap has unfairly double-taxed families across the country and worked to defund our states’ critical priorities,” said Reps. Bill Pascrell, Jr., D-N.J.; Tom Suozzi, D-N.Y.; Josh Gottheimer, D-N.J.; and Mikie Sherrill, D-N.J., in a joint statement.

If double-taxation is an issue I can think of a lot of other things that should be looked at.

Let's start with FICA taxes. We aren't allowed to deduct FICA taxes on our income tax return. That is double taxation.

I pay gasoline or sales tax on purchases with money earned through income that has already been taxed. That is double taxation.

Why do we have an estate tax? It is effectively a double tax on money earned while someone was living and working.

Why do we tax dividends? Those are just distributions of profits that have already been taxed at the corporation level.

If the SALT limit results in unfair double taxation all of these do as well.

I will personally benefit from the increase in the SALT limit. However, this makes no sense.

Nothing about this makes much sense.

Calling social spending infrastructure. Telling us it would cost nothing. Saying it is anti-inflationary. Taxing the rich and then giving the second largest benefits to the rich.

Someone once said that "Laws are like sausages. It is best to not see them being made."

I might add that we also should not be subjected to the baloney that comes out of the mouths of politicians to try to sell stuff like this to the voters.

Sausage and baloney.

There is a lot of it in Washington in the Biden years.

There is no free lunch.

The costs of this package of sausage and baloney is far from ZERO.

No comments:

Post a Comment