I wrote a blog post three years ago on what was the emerging fad involving fake meat.

A company named Beyond Meat had recently gone public in an IPO.

When I wrote about Beyond Meat it had a total stock market value of $14 billion.

It had $95 million in annual revenue and had a net loss of $27 million in the most recent year.

To put that $14 billion market value in context I pointed out that made Beyond Meat more valuable than two giants in the food industry---Campbell's Soups and Conagra.

These are the brands that Campbell's owns.

These are the major brands that Conagra owns.

Beyond Meat was going to need to convince a lot of people to eat fake meat to justify that valuation.

I wrote at the time that my guess was that this was not going to end well for Beyond Meat shareholders.

That ought to give you a perspective on how much money is being bet that you will eat fake meat.

However, will you really eat fake meat?

Count me as someone who is not buying Beyond Meat at $235 per share.

How has Beyond Meat done the last three years in selling fake meat?

How have its shareholders done?

However, the company lost $98 million on those sales.

That amounts to an operating loss of an astounding 92% of sales!

It doesn't get much worse than that.

|

| Source: https://www.fool.com/investing/2022/05/17/how-beyond-meats-losses-hit-a-jarring-92-of-sales/ |

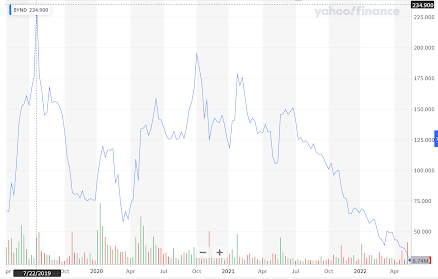

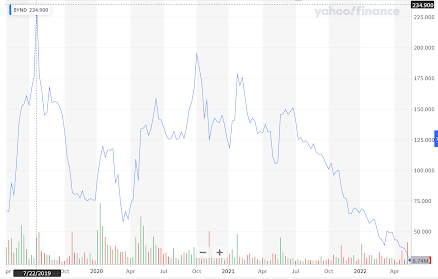

How have the shareholders of Beyond Meat done?

I wrote that blog post right after Beyond Meat had hit almost $235/share.

|

| Beyond Meat (BYND) |

The stock is now trading at below $27/share. You are down over 88% if you bought stock in Beyond Meat in July, 2019.

It is down almost 60% just since January 1, 2022.

Ouch!

Of course, there are many other stocks like Beyond Meat which have been annihilated in the current market environment.

Some of these have much better track records and performance than Beyond Meat.

Coinbase Global -73%

Netflix -68%

Caesar's Entertainment. -45%

Intuit -41%

Tesla -37%

The stock market has not been the only investment sector that has been hit hard in 2022.

Crypto currencies have also fallen.

One of the arguments given by those who are fans of cryptos such as Bitcoin was that it was a store of value and that it would have little correlation with traditional investment classes making it an ideal asset to protect one's wealth.

Bitcoin is down 36% since the first of the year.

It was as high as $67,000 last November. It is around $30,000 right now.

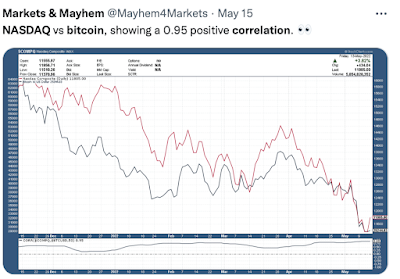

What is particularly interesting to me, contrary to the argument that Bitcoin has little correlation to other investment classes, is that Bitcoin has fallen almost in lockstep with the NASDAQ index.

In fact, it is a .95 positive correlation.

Bitcoin doesn't look like a store of value right now.

It looks like just another risky asset class.

The New York Times prepared this chart that compared the performance of gold, NASDAQ and Bitcoin thus far this year.

Bitcoin and the stock market did well when interest rates were low and the Federal Reserve was supplying all sorts of liquidity to the markets.

The question is how well will Bitcoin, Beyond Meat and a bunch of other investment do when the Fed is no longer filling up the punch bowl at the party?

The early returns are not encouraging.

In fact, at Bitcoin's current value about 50% of the owners of this crypto are already underwater on their investment.

It has always been true that as interest rate yields get more attractive, riskier asset classes have a harder time attracting buyers.

For more than a decade the Federal Reserve kept interest rates at historically low levels in order to entice more and more people to put their money in riskier asset classes in order "to help the economy".

If we look at the high prices that some investors paid for Beyond Meat, Bitcoin and other names they succeeded in what they set out to do.

The further question is what type of damage did the Fed do to those investors and the economy in the long term?

We will find out together.

You can read the entire quote below but the essence is that Buffett would not pay $25 for all the cryptocurrency in the world.

I would not call that a vote of confidence from someone who is arguably the greatest investor of all time.

“If you said … for a 1% interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon,” Buffett said. ”[For] $25 billion I now own 1% of the farmland. [If] you offer me 1% of all the apartment houses in the country and you want another $25 billion, I’ll write you a check, it’s very simple. Now if you told me you own all of the bitcoin in the world and you offered it to me for $25 I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent and the farms are going to produce food.”

Beyond Meat might still be a potential investment for Buffett.

You just have to get people to want to eat fake meat.

If things continue as they are right now, we may get to that point much sooner than we want.

|

| Source: https://www.ft.com/content/17d7e07f-46c6-4c41-9202-e445928a405a |

No comments:

Post a Comment