How high will inflation go?

Last month saw an 8.6% year over year increase in the Consumer Price Index.

It is the highest we have seen in over 40 years.

Here is a sampling of some of the items in the index.

|

| Credit: https://twitter.com/byHeatherLong/status/1535245905045209090 |

You might notice that the shelter component (rent above) is only showing a +5.2% increase over the last year.

How can this be when home prices are +20.6% and rents are +15.4% over the last year?

The CPI shelter number is 5.2% while actual costs are at least three times higher due to the fact that the calculation for shelter in the CPI is only done semi-annually and totally ignores the actual cost of housing. It is based solely on a survey of what home owners say they would be willing to rent their house for as well as a survey of what renters say they are paying.

However, since that survey question is only asked twice per year it is totally inadequate to reflect actual costs in a period where prices are increasing quickly.

Considering the fact that shelter is the largest component in the index (33% of the total) it is clear that actual inflation is much higher than what is being reported right now.

However, if the shelter number catches up we will undoubtedly see higher inflation pressures based solely on that number even if some of the other components begin to stabilize over time.

If CPI was being calculated the same way it was in 1981 we would now be seeing an inflation number of just over 17% according to an economist who calculates the index using the prior methodology.

|

| Source: http://www.shadowstats.com/alternate_data/inflation-charts |

At some point, we should see some moderation in the index if for no other reason than the base index gets higher with each succeeding month,.

At some point the CPI number will come down. That doesn't mean current prices are going to go down.

If gas prices are the same next year that would be a 0% increase in the CPI index. Keep in mind the CPI is only measuring price changes over the last year. The base the CPI is being measured against is getting larger every month for the inflation that started just over a year ago.

Looking at the data I would expect inflation to remain at least 8% through September assuming there is not a total meltdown of the economy that will drastically cut demand pressures.

Last October is when inflation really starting taking off which is going to provide higher base numbers in the CPI calculation for 2022.

|

| Source: https://www.bls.gov/news.release/pdf/cpi.pdf |

I am also assuming that the increases in shelter costs are going to start working into the numbers over the next several months.

It is not out of the question that the economy could roll over into a recession in the next few months.

Consumer sentiment has not been this low since 1952 when the University of Michigan first started tracking it. It should not be lost that there were a lot of times in those 70 years when things looked very bleak. It says something when consumer sentiment is at this level right now.

A big reason for the pessimism is that wage earners are losing ground every month due to high inflation.

We have now seen 14 consecutive months of negative real wage growth.

Nominal wages have been increasing (+11.9% since February, 2020) but prices have increased more.

At the same time in 1981, the last time we saw this level of inflation, the Fed Funds rate was over 13%. Today it is still below 1%.

How much higher will interest rates have to go to bring down inflation and what will it do to the economy, stock market values and home prices?

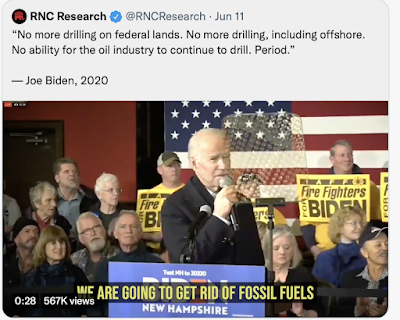

In the meantime, Joe Biden and the Democrats seem to be incapable of understanding how much of the inflation we are seeing now can be traced directly to their attacks on the U.S. energy sector and their contempt for the use of fossil fuels.

Energy is the most important factor in economic growth. Energy makes the world economy go. We need it for anything we want to do. It needs to be available and it needs to be affordable. The economy does not work without energy. The consumer cannot spend on other things in the economy if they are spending excessive amounts on energy. If the consumer doesn't spend, the economy does not grow. If the economy does not grow, eventually more and more people go without jobs.

Energy costs get baked into everything in the economy. The fuel the farmer uses to plow his fields. The energy used to dry the crops. The fuel needed to transport the grain. The energy necessary to power the bakery that makes the break. The fuel for the truck to get bread to the market.

When those costs go up employers need to increase wages of their employees due to the higher prices. This in turn turns into a cost/push inflation cycle that pushes prices higher and higher.

Joe Biden is now complaining that the oil companies are making too much money and they need to drill more.

President Joe Biden slammed Exxon Mobil on Friday for what he described as the oil giant’s greedy reluctance to produce more petroleum, just hours after U.S. economists said inflation in May rose at levels not seen since the early 1980s.

However, on the campaign trail he stated that oil executives should be put in jail for drilling for oil.

|

| Source: https://www.dailymail.co.uk/news/article-7837265/We-jail-Biden-wants-prosecute-fossil-fuel-executives-environment-damage.html |

|

| Credit: https://twitter.com/RNCResearch/status/1535667434912464897 |

Perhaps there is a reason that oil companies are not drilling for more oil?

Does Biden not understand that his policies are the reason that all the oil that ExxonMobil and others already have has become much more valuable and could be sold for much higher prices?

The only blessing in this is that the public at large has been provided a glimpse of what happens to the world when fossil fuels are abandoned on a "promise" of a green economy.

Things get very expensive and the outlook for everybody gets very bleak in a short period of time when energy costs increase.

Green economics schemes that are done to "save the planet" will inevitably destroy the economy in the process. The only way to avoid that result is if the cost of the new energy inputs are more affordable than fossil fuels.

I have great confidence that given free markets economies and human ingenuity we will find better sources of energy to power our lives. This has been proven time and time again over the course of human history.

However, we have never voluntarily abandoned something that is accessible and affordable for something that is speculative and expensive.

We are in the process of learning a hard lesson

Let's hope that enough people understand it to do something about it.

If not, we have not begun to see where this ends.

No comments:

Post a Comment