Interest rates are rising.

This is creating winners and losers.

The big winner is anyone who is relying on interest income.

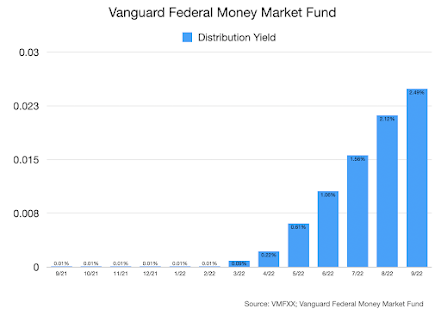

For example, let's take someone who has had money invested in Vanguard's Federal Money Market Fund.

This fund invests in very short-term U.S. government debt securities with the objective of providing current income to investors while maintaining a stable $1 net asset value.

This is an alternative to a bank savings account for many investors.

Look at the distribution yield on this fund over the last 12 months.

It has risen from .01% to 2.49% in seven months.

For someone with $100,000 invested, they would not have earned $100 in interest income from this investment in 2021.

Investors in this fund today can expect about $2,500 in annual income---a 25x increase.

Winner.

A big loser today is anyone who is in the market to buy a home and needs a mortgage loan.

30-year mortgage rates are now over 6.5%.

The monthly mortgage payment on the median asking price home in the United States is now about 50% more than it was a year ago.

|

| Source: https://www.redfin.com/news/housing-market-update-welcome-to-the-new-weird/ |

Stock market investors are also big losers as interest rates rise.

Stocks get much more attractive as interest rates decrease and much less attractive as rates increase.

The ultra low interest rates of the last decade persuaded many investors to abandon interest income investments in favor of stocks. There was simply no return to be had.

That process is now being reversed.

We can see the pain being administered in this process every day of late.

Of course, the other biggest loser is the United States government which now has almost $31 trillion of debt it must pay interest on.

That really translates to the ultimate losers in the end.being the American taxpayer or those who depend on federal government spending.

The problem is that not only is the debt rising but the interest that must be paid on the debt is rising as well.

|

| Source: https://usdebtclock.org |

I doubt that many Americans grasp how serious this combination of rising debt levels and interest rates is.

This chart from Charlie Bilello provides some perspective of what this already means.

Interest expense has gone from $482 billion to $716 billion over the last twelve months.

As the debt and interest rates increase, the cost to finance the debt is rising dramatically.

Another chart from Bilello shows the difference in U.S. Treasury yields on 9/13/22 compared to 12/31/21.

|

| Source: https://compoundadvisors.com/2022/10-chart-thursday-9-15-22 |

We are at the point now that a 1% increase in the average interest rate paid by the federal government will increase interest expense on the debt by over $300 billion per year.

A 2% interest rate rise will increase interest costs by over $600 billion.

A 3% increase in interest rates will increase interest costs by almost $1 trillion annually.

If you think these increases are far-fetched, a 3% pont increase in the average interest rate paid on federal debt would only take us to about a 5% overall rate. The U.S. was paying this average interest rate in 2009. It was paying 11.3% in 1981 in average interest rate costs the last time we had inflation anywhere near to what we have today.

For context, consider what the U.S. government is currently spending annually on various spending categories beyond interest on the federal debt.

The U.S is spending about $750 billion this year on defense spending.

The U.S is spending another $750 billion on all other so-called discretionary spending (education, law enforcement, government administration, public health, housing etc).

The remaining $4 trillion is spent on what are called mandatory programs.

Social Security $1.2 trillion

Medicare, Medicaid and Obamacare subsidies $1.7 trillion

Welfare, food stamps, etc. $600 billion

Federal, military retirement and veterans' benefits $500 billion.

Something has to give if interest rates continue to increase as well as the U.S. federal debt.

This analysis indicates that interest expense will consume almost 40% of all federal revenues by 2052. It is less than 10% right now.

|

| Source: https://www.pgpf.org/analysis/2022/09/higher-interest-rates-will-raise-interest-costs-on-the-national-debt |

There appear to be no good answers on how this is going to play out if this accumulating mountain of interest expense is going to be paid.

Taxes are going to have to go up a lot.

Or federal spending is going to increasingly get crowded out by the necessity of paying the interest on the federal debt.

Or the Fed will have to reverse course on interest rates to save the federal government which will result in hyper inflation which will eventually wipe most of the federal debt away (and the fortunes of those who invested in the federal government debt and securities).

Makes sure you do what you need to do to be a winner rather than a loser as interest rates rise along with the federal debt.

Scott

ReplyDeleteNot sure there can be any winners under the gloomy scenarios you are describing. It won’t be possible to cover the increased interest burden caused by the higher interest burden by raising taxes or decreasing spending. Existing non-discretionary programs will face rising costs due to inflation and the aging of the population. The only alternative I see to cover the increasing interest burden is additional borrowing which of course will increase the principal amount on which future interest payments will be computed. How long will investors in Treasury instruments allow that to go on before the credit-worthiness of the U.S. Treasury is questioned? If investors lose faith and stop buying, then default becomes inevitable.