Are we heading into a recession in the United States?

There are many who are predicting a recession is on the horizon.

The Atlanta Fed's GDP Now forecast is estimating first quarter GDP at -2.1%.

|

| Source: https://x.com/NorthmanTrader/status/1901673454497137109/photo/1 |

However, the New York Fed is projecting GDP at +2.7% for the same period.

|

| Source: https://x.com/NorthmanTrader/status/1901673454497137109/photo/2 |

For context, it is important to take into account that the Federal Reserve employs over 500 economists with more than 400 holding PhD's.

Keep in mind that this is the same group who were telling us that inflation would be transitory a few years ago.

You can make your own determination about how much confidence you might want to place in a GDP forecast by any Federal Reserve economists.

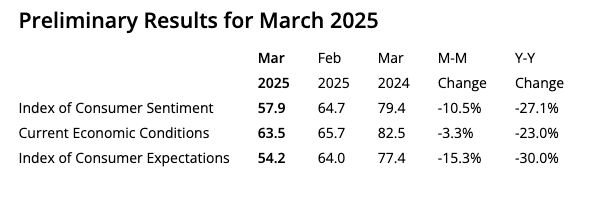

A survey of consumers from the University of Michigan recently showed a consumer sentiment score of 57.9 which is down significantly from a year ago.

This is also the lowest consumer sentiment score in the survey since inflation was raging in the summer of 2022.

|

| Source: http://www.sca.isr.umich.edu/ |

When consumer confidence wanes it usually follows that consumer spending trends down.

Consumer spending also accounts for about 70% of what comprises GDP.

If consumer spending drops it almost certainly will result in a recession.

The other factor in all of this is that 50% of all consumer spending today is the result of spending of those in the top 10% of income earners ($250,000+ of annual income).

We also cannot ignore the role that government spending has in all of this.

There is little question that the last four years would have seen much worse GDP numbers but for the significant amount of government spending and jobs.

34% of U.S. GDP came from government spending in 2024. That is the highest it has ever been with the exception of times of war or crisis.

In addition, 2 million government jobs were added in the last four years.

There are a lot of factors at play here but my view is that President Trump and Treasury Secretary Bessent are not adverse to bringing the economy down a notch or two right now.

|

| Link: https://x.com/unusual_whales/status/1901393286868472266 |

First, they understand that the concentration of wealth and income at the top in not a healthy situation for the United States long-term. Trump also understands that a good deal of his support did not come from Wall Street and that top 10%.

Second, the large amount of government spending and money printing has fueled large increases in housing prices and stock prices in recent years that has disproportionately benefited the top 10% but has disadvantaged large groups of people (particularly the young).

Third, the federal government desperately needs interest rates to come down in order to finance the $36 trillion of federal debt.

In 2020, the average interest rate on federal debt was 1.772%. It is now 3.282%.

At the same time, total federal debt outstanding has gone from $23 trillion in 2020 to over $36 trillion today.

|

| Source: https://fred.stlouisfed.org/series/GFDEBTN/ |

As a result, the United States is now spending well over $1 trillion per year just on interest on the federal debt.

It was spending only $400 billion per year in 2020.

|

| Source: https://fred.stlouisfed.org/series/A091RC1Q027SBEA |

For context, personal income tax collections for the current year are projected to be $2.6 trillion meaning that it is taking almost half of our income taxes just to pay the interest on the federal debt.

The total Defense Department budget is only $850 billion.

It is simply unsustainable.

That is why the DOGE effort is so important.

The United States simply cannot afford to keep adding $2 trillion of debt every year from deficit spending.

It also cannot continue to pay interest at the rates in effect right now.

And it is going to take an economic slowdown and/or loss in asset values to bring interest rates down.

Trump and Bessent also know that it is preferable to take air out of the ballon in a controlled manner than to let it suddenly and dramatically burst which is inevitable if natural forces are left alone.

You simply cannot have the excesses we have seen in government spending, debt and money printing in recent years without a brutal correction at some point.

Fourth, there are only two ways out of the gigantic deficit and debt hole that Trump has inherited. The most obvious path is for government to inflate the debt away. The federal debt becomes manageable by destroying the currency. Of course, this also destroys the wealth of much of the population. The second option is to constrain spending going forward (DOGE), seek new revenue sources (tariffs) and grow the economy at a faster rate than government spending. Trump is totally focused on the second option.

Fifth, Trump and Bessent also understand if there has to be some pain it is far better from a political standpoint to take it early in this term. To fully implement the Trump agenda is going to require stronger Republican majorities in the 2026 mid-term elections. Better to clear the decks now so that any pain is in the real view mirror than front and center in 2026.

Is a recession ahead in 2025?

The excesses of the last four years make it hard to avoid in the best of circumstances.

If you add to this the fact that Trump and Bessent have clearly signaled that they are willing to take some pain now for longer term gains makes me believe that we will see a visible slow down before the end of the year.

Plan accordingly.

No comments:

Post a Comment