You likely have never heard his name unless you are a long-time reader of BeeLine.

I have cited his work a number of times over the years.

He did more to allow us to understand the human mind and how we make the decisions than anyone else in history.

His name was Daniel Kahneman.

|

Daniel Kahneman, 1934-2024

Photo: Flickr/NRKBeta (Creative Commons BY-SA 2.0) |

He passed away last week at 90 years of age.

Together with Amos Tversky (who died in 1996), Kahneman created an entirely new field called "Behavioral Economics".

Kahneman won the Nobel Prize in Economics in 2002 even though he was trained as a psychologist.

Kahneman and Tversky changed forever the way that economists and others viewed the human mind and the way we make decisions. Until their groundbreaking studies, it was generally conceded that humans made rational and logical decisions with the brain acting like a sophisticated computer.

Though their work and efforts we learned just how wrong that is. Their research showed in innumerable studies how the human mind errs in systematic ways leading to poor judgments, especially in uncertain situations.

Kahneman wrote a book in 2011, "Thinking Fast and Slow" in which he detailed much of what he had learned over the years about how we think and make decisions.

He explains that most decisions are made very quickly without a lot of thought.

"A remarkable aspect of your mental life is that you are rarely stumped. The normal state of your mind is that you have intuitive feelings and opinions about almost everything that comes your way. You like or dislike people long before you know much about them; you trust or distrust strangers without knowing why; you feel that an enterprise is bound to succeed without analyzing it'"

Kahneman found that the human mind makes decisions based on two systems of thinking.

He referred to them this way.

System 1---Fast Thinking

System 2---Slow Thinking

"System 1" thinking corresponds to fast, intuitive, emotional and almost automatic decisions, though it sometimes leaves us at the mercy of our human biases.

"System 2" thinking is more slow-going and requires more intellectual and analytical effort. To nobody's surprise, humans are more likely to rely on System 1 thinking, because it saves us effort, even if it can lead to flawed thinking.

When I observe what is going on in the world I often think about Kahneman's findings in attempting to make sense of it all.

For example, Kaheman and Tversky found that Fast Thinking often makes us much more susceptible to errors in judgment. We can be lulled into a false sense of security with this fast thinking.

Anything that makes it easier for the associative machine in your brain to work will also bias your thinking. A perfect example is familiarity. Generally, if something is familiar you feel more confident and secure in your thinking and beliefs. This can easily lead us astray .

Consider this statement of Kahneman in his book.

"A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth".

In fact, authoritarian institutions and marketers have known this for a long time. In effect, if you repeat anything (including outright lies) often enough it will tend to be believed. This is particularly true if it is repeated often enough by an authority figure.

Kahneman found that repetition induces cognitive ease and a comfortable feeling of familiarity. It begins to feel like truth when it could be anything but.

You want to know why so many people dutifully followed what they were told during Covid without asking many questions (closing businesses, schools, playgrounds, masking, vaccine mandates, etc) although any critical analysis and prior public health protocols and planning showed the policies were flawed?

Why do so many believe the climate change narrative?

Frequent repetitions. More and more familiarity with what is said. It all makes you feel more confident and secure in your beliefs. However, familiarity is not the TRUTH although you may think and feel it is.

Understanding these insights from Kahneman explains a lot, doesn't it?

It is particularly relevant today.

It is also very troubling when you consider how easily the government authorities can use inflation to steal from the public without most believing it to the the theft it is.

The study tracked responses on whether respondents believed that certain outcomes were "fair" in economic terms.

The base case factual pattern was as follows.

A company is making a small profit. It is located in a community experiencing a recession with substantial unemployment but no inflation. There are many worker anxious to work for the company. The company decides to decrease wages and salaries 7% this year.

62% of respondents judged this to be UNFAIR. 38% said it was ACCEPTABLE.

A second version of the question had a modification to the above with the identical facts with two small changes.

Instead of no inflation the facts were changed so that there was "12% inflation" and the company was said to decide "to increase wages only 5% this year".

Notice that in both cases the workers have lost 7% of their purchasing power in real money terms.

However, 78% said that the second version was ACCEPTABLE or FAIR and only 22% judged it UNFAIR.

The fact that they gained something in one pocket in the second version was all it took for them to ignore the fact that even more money was coming out of their other pocket.

I think of this study often as I see what is going on right now with inflation and where the United States may be heading in the future with $34.5 trillion in debt and a Federal Reserve that can print money at will.

Inflation is the easiest policy option for government to solve its debt problems. It is also the easiest way to hoodwink the public. It just does not feel like you are losing if your wages are going up rather than going down.

Fast thinking is also first order thinking. Most people are not able to consider the full second order effects beyond the immediate impact on their paycheck or bank account.

Receiving a 2% social security increase when prices are rising 10% just doesn't feel as bad as having your social security payment cut by 5% when inflation is 2%. You are actually better off with the 5% cut from a buying power perspective. Most people just don't think or feel that that way.

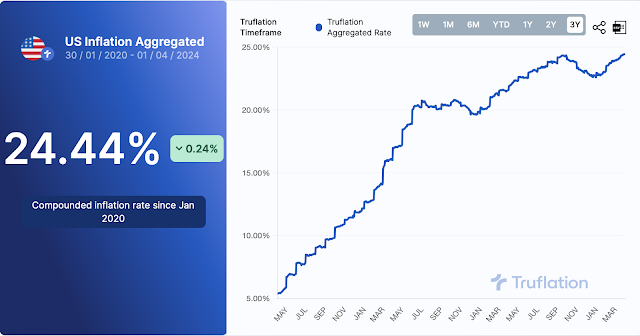

We all know that inflation has been bad the last couple of years.

However, did you realize it was this bad?

Inflation has eviscerated almost a quarter of your wealth over the last four years.

It probably does not FEEL quite this bad because you might have gotten some salary increases, Social Security hikes or the stock market has treated you to some gains over that period.

If you need a more relevant, real life example consider this data regarding the increases in prices at various fast food restaurant chains over the last ten years.

For example. prices at McDonald's are up 100% in the last ten years compared to an overall 31% inflation rate. Of course, 24% points of that 31% increase in price levels has occurred in just the last four years.

|

Source: https://financebuzz.com/fast-food-prices-vs-inflation

|

Those price increases at fast food chains are primarily due to higher food and labor costs.

However, even with fast food workers making more money, they are falling further behind due to inflation.

This chart from the Federal Reserve makes that abundantly clear.

The red line shows increases in Personal Consumption Expenditures (PCE). That is the inflation measure that the Fed looks at most closely.

The blue line is real personal disposable personal income.

The green line is median usual weekly real earnings for wage and salary workers.

|

| Credit: https://twitter.com/QPollsandnews/status/1773813937865142309 |

Inflation is winning. Actual incomes from 2020 are up but inflation has vastly outpaced salaries and wages. Real disposable income and salaries and wages are both substantially lower now than they were just several years ago.

Those who are regular BeeLine readers know that I don't like making predictions because it is too easy to be wrong.

However, what should we expect going forward with inflation knowing how Kahneman demonstrated the way people think and view fairness?

It is hard to see where inflation will not be a big part of our future for the foreseeable future unless we end up with a significant recession or depression that increases unemployment levels.

The Federal Reserve has dual objectives in its charter---maintain full employment and control inflation.

However, considering where we are now, the Fed is unlikely to increase interest rates to the level necessary to tame inflation because of concerns about unemployment.

Keep in mind that interest also has to be paid on over $34.5 trillion in federal debt.

At current interest rates that requires almost half of all individual tax revenues that are collected.

Inflation also devalues the amount of that debt over time providing a way for the federal government to avoid being buried by it.

My prediction is that the Fed will be more concerned with employment (and the interest rates the government has to pay on its debt) than controlling inflation.

The sad truth is that inflation is the government's friend but it is the enemy of the working man or retiree living on a fixed income or fixed assets.

Few understand how government is given a license to steal with inflation

Worse yet, those who are being stolen from do not even understand the extent of the theft as the Kahneman's work above demonstrated.

Everything above points to more inflation in the future as it is the easiest way out of the government debt problem at the lowest political cost from angry voters.

In many respects, we resemble the Roman Empire during its decline.

History may not repeat but it does rhyme. Unfortunately, we see similar missteps and errors time and again over the years due to the humans who are at the center of it all.

The Romans understood how the human mind works well before Daniel Kahneman documented it with his supporting research 2,000 years later.

As Rome's problems deepened it was necessary to divert and distract the populace on the larger concerns of the republic. The Romans did this by providing free wheat for everyone and making sure there was always entertainment available to all. They understood "Fast Thinking" and wanted to insure the most basic human needs were met. This meant that few concerns or questions were raised about the real underlying problems of Rome.

A poet of the day, Juvenal, put it this way as he observed the decline around him and wrote of his frustration with what he saw unfolding before his eyes from his fellow Roman citizens.

The fast thinking parts of our brain loves bread and circuses.

Expect a lot of distractions to divert your mind from the real underlying issues facing the United States in the future.

In Rome, the bread and circuses eventually could not be sustained and by the time the masses woke up it was too late.

There were simply not enough slow thinkers like Juvenal around to save Rome.

We need more slow thinkers.

We need a LOT of them.

And we need them NOW.

Thank you to Daniel Kahneman for all his contributions in making sense of a world around us that often makes no sense.

No comments:

Post a Comment