Another edition of Monday Meanderings with focus on seasonality and Covid, the November jobs report, inflation and what has happened to the stock price of Beyond Meat.

Seasonality Overwhelms Everything Else With Covid

Over most of the last month Michigan has been leading the nation in new Covid cases. It has now dropped to third behind New Hampshire and Minnesota.

89% of every man, woman and child in New Hampshire has had at least one dose of the vaccines according to The New York Times

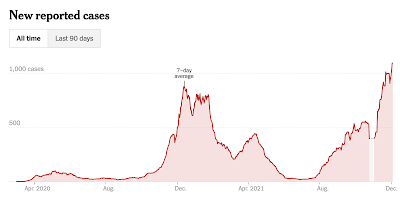

The 7-day average of 1,096 new daily confirmed cases is 24% higher than the previous high that was reached December 13 of last year before vaccines were available.

|

| New Reported Cases in New Hampshire Credit: https://www.nytimes.com/interactive/2021/us/new-hampshire-covid-cases.html |

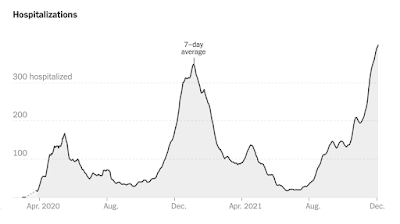

Hospitalizations with Covid have also hit record levels in New Hampshire.

|

| Hospitalizations with Covid in New Hampshire Credit: https://www.nytimes.com/interactive/2021/us/new-hampshire-covid-cases.html |

This seems to be at odds with the claims that the vaccines prevent severe illness even if they do not prevent someone becoming infected with Covid.

In looking at the New Hampshire data above, you might notice the amazing seasonal congruence of waves of Covid in the state. Daily cases this year are reaching a peak at almost at the same exact time that the peak was reached last year. The same with hospitalizations. It is quite remarkable.

You see this seasonal congruence even more starkly when looking at this HHS graph of Covid hospitalizations in Michigan that compares 2021 vs, 2020.

|

| Credit: https://twitter.com/Hold2LLC/status/1467153137752543232/photo/1 |

The peaks in hospitalizations in the state are falling on almost the same dates in 2021 as they were in 2020.

Doesn't this raise some questions as to whether any of the interventions (masks, lockdowns, vaccines) are making a substantial difference against the nature of the virus?

Jobs and Unemployment

Employment numbers were released last week for November and Joe Biden and the Democrats were attempting to spin the numbers to suggest that we are in the midst of the greatest economic recovery in history.

Biden highlighted the fact that the unemployment number had dropped to 4.2%.

However, the fact is that the economy only produced 210,000 jobs in November. Economists had predicted 550,000 new jobs after 546,000 jobs had been added in October

Even CNN's fact checkers called out Biden for promoting at least four significant false claims he made in his speech on Friday.

When CNN is fact-checking a Democrat you know that the claims are getting pretty outrageous.

A big part of the narrative that Biden and the Democrats have been pushing is that stronger Covid measures (vaccine mandates, mask mandates etc) are what is necessary for a strong economy.

In fact, here is Biden's Chief of Staff, Ron Klain, on Twitter recently challenging a Wall Street Journal reporter who wrote an article stating that the Covid measures in Democrat states were hurting the economy.

What does the data say?

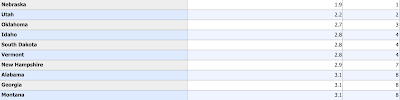

According to the Bureau of Labor Statistics, below are the 10 states with the lowest unemployment rates. (these rates are from October since state breakdowns have not yet been made available for November).

These ten states are averaging 2.7% unemployment.

Every one of these 10 states is led by a Republican governor.

|

| Source: https://www.bls.gov/web/laus/laumstrk.htm#laumstrk.f.p |

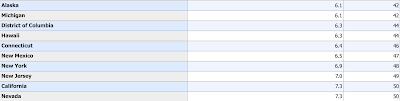

These are the 10 states with the highest unemployment rates.

These 10 states are averaging 6.6% unemployment.

9 of these 10 states are led by a Democrat governor. Alaska is the exception.

|

| Source: https://www.bls.gov/web/laus/laumstrk.htm#laumstrk.f.p |

Does anyone doubt that the Covid measures are much, much stricter in states with Democrat governors and the highest unemployment rates are in these states?

Biden and Klain appear to be claiming credit for things that they have had nothing to do with and trying to defend mandates which are hurting, rather than helping, the economy.

Never mind the facts. The strategy seems to be to just keep repeating the narrative and hope that people will believe it.

However, it has gotten to the point that even CNN is not buying it.

Inflation

A simple explanation for inflation is that it occurs when there is too much money chasing too few goods.

Demand outpaces supply and this results in prices of goods (or labor) increases.

A few charts that provide context as to why we may be seeing inflation in so many sectors of the economy right now.

The retail sales-to-inventory ratio has never been higher. This indicates there is very little inventory supply supporting what is being sold. Low auto inventories are a big factor in this number but shortages are appearing in a number of sectors.

Not enough supply to meet demand.

|

| Credit: https://twitter.com/LizAnnSonders/status/1465657385821818884 |

In the meantime, Americans have never seen larger increases in the cash they have in the bank.

There is a lot of cash awash in the system to push consumer demand.

|

| Credit :https://twitter.com/bpmehlman/status/1466434486971871238/photo/1 |

The cash in bank accounts does not include another $1.1 trillion that has flowed into the stock market in the last 12 months.

That inflow to equities exceed the combined inflow of the past 19 years!

|

| Source: https://twitter.com/bpmehlman/status/1465652531921670149 |

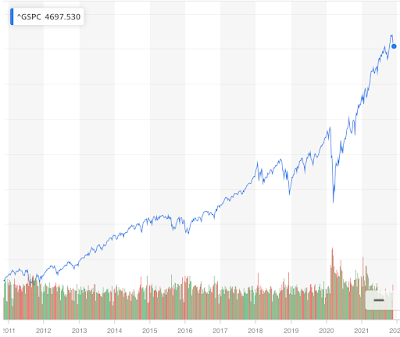

The principles of supply and demand also drive stock prices.

A lot of money chasing a limited number of equities to invest in.

That is how you end up with a chart of the S&P 500 that looks like this.

|

| Source: https://finance.yahoo.com/ |

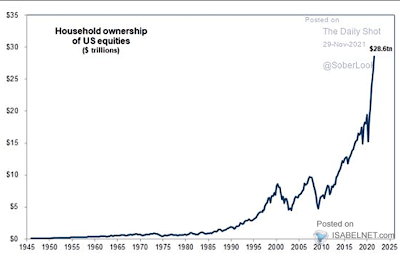

American households now have almost $29 trillion invested in U.S. equities.

|

| Credit: https://twitter.com/ISABELNET_SA/status/1465644231809282055 |

That is double what it was after the initial Covid crash in March, 2020 and almost triple what it was six years ago.

A lot of people must be feeling rich.

Of course, I find it interesting that the $28.6 trillion in household ownership of equities is not even equal to the amount of federal debt right now.

It has just gone over $29 trillion.

|

| Source: https://www.usdebtclock.org |

Of course, it is guaranteed that the U.S. national debt is going to be much higher day after day into the future.

The interest on the debt alone assures us of that.

There is no such guarantee that the values of U.S. equities will do the same. What goes up has been known to come down.

Despite all of these facts, the Democrats want to pass legislation to spend another couple of trillion dollars so we can "Build Back Better?

Is what we are seeing right now anywhere close to "better"?

Beyond Meat

In July, 2019 I wrote a blog post about all of the hype going on at the time about "fake meat".

The biggest name in the sector, Beyond Meat, had gone public in May, 2019 and the stock price had advanced 840% in the two months since its IPO.

I pointed out in "Will You Eat Fake Meat?" that Beyond Meat had a market cap of $14 billion and had gone up $3.6 billion in the last week alone.

That meant the fake meat company had reached a value that made it more valuable than other food giants like Smucker's, Campbell's Soup and Conagra at its stock price at the time of $235/share.

For perspective, all of these brands are owned by Campbell's.

These are the food brands that Conagra owns.

A company with a meat that is not meat of which the prime ingredient is "pea protein" was valued at more than companies with all of these established brands?

All of this told me that the narrative about Beyond Meat had gotten very far beyond reality.

That ought to give you a perspective on how much money is being bet that you will eat fake meat.

However, will you really eat fake meat?

Count me as someone who is not buying Beyond Meat at $235 per share.

You can also probably count me as someone who is also not going to eat a Beyond Meat burger anytime soon.

Why? My appetite for Fake Meat is about the same as it is for Fake News.

No comments:

Post a Comment