It seems that wherever you live you have undoubtedly seen real estate values soar.

Home prices in the United States increased an average of 17% in 2021.

|

| Source: https://www.cnn.com/2022/01/20/homes/us-nar-home-sales-december-and-2021/index.html |

Three metro areas had increases that exceeded 30% in 2021 (from Oct, 2020 to Oct 2021) to lead the nation.

Austin/Round Rock, TX +33.5%

Naples/Marco Island, FL +32%

Boise, Nampa, ID +31.5%

If you take a step back there is no other asset class that is more responsible for global wealth than real estate values.

This color graph gives you a sense of the relative values of the major global asset groups as of the end of 2021.

|

| Source: https://twitter.com/MacroAlf/status/1489980931662352390/photo/1 |

The actual global values as of 12/31/21.

Real estate---$326 trillion ($256 trillion residential, $35 trillion agricultural, $32 trillion commercial)

Bonds---$124 trillion

Equities---$109 trillion

Gold---$12 trillion

Crypto---<$2 trillion

In other words, a 10% loss in real estate values carries 3 times the pain to global wealth compared to a similar loss in equities or bonds.

Most real estate is also leveraged with mortgage debt making valuations particularly sensitive to changes in interest costs.

We saw what can happen in 2008-2010 when cracks in the foundation start to appear.

30-year mortgage rates have risen almost one percentage point since a year ago.

@MacroAlf fills in the blanks.

What goes up can come down.

Global real estate values increased by about $100 trillion (43%) in the last four years. Almost all of that has been in the value of residential real estate. Commercial real estate values have not changed over that period as the internet economy and Covid restrictions have adversely affected this sector.

Leverage is great on the way up. There is hell to pay on the way down.

Global equities are up 56% since 2017. Of course, equity prices have also been supported by low interest rates that have made interest-bearing securities and accounts unattractive for a number of investors.

However, in 2021 in the United States, you actually made more money owning a used car than owning the S&P 500 Index.

|

| Credit: https://twitter.com/NorthmanTrader/status/1490994031387885568/photo/1 |

All of this seems to have been heavily affected by the pumping of the money supply and printing of money by the Federal Reserve and others around the world.

M1 is defined by economists as the money supply which includes currency in circulation, demand deposit bank accounts, savings accounts and other liquid accounts that can quickly be converted to cash. It does not include bonds.

Money quickly goes to where it is treated best. Real estate and equities have been much more attractive than bonds the last several years. A lot of cash has flowed into real estate and stocks.

How many want to invest money in a 30-year T-bond yielding 2.25% when inflation is running at 7%?

Does any of this look normal in any way?

How REAL are current real estate prices (or stock prices for that matter)?

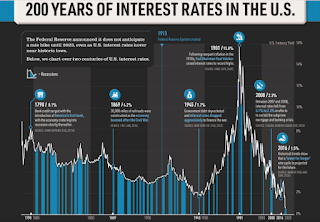

What do things look like with anything close to historical interest rates?

|

| Credit: https://advisor.visualcapitalist.com/us-interest-rates/ |

Some argue that due to these facts the world's central bankers are boxed in. They cannot allow real interest yields to increase without risking a monumental crash of the entire world's financial system.

Can they defy gravity and reality forever?

Stay tuned.

This may be a good time to consider what Will Rogers once said.

No comments:

Post a Comment