It seems that wherever you live you have undoubtedly seen real estate values soar.

If you take a step back there is no other asset class that is more responsible for global wealth than real estate values.

This color graph gives you a sense of the relative values of the major global asset groups as of the end of 2021.

|

| Source: https://twitter.com/MacroAlf/status/1489980931662352390/photo/1 |

The actual global values as of 12/31/21.

Real estate---$326 trillion ($256 trillion residential, $35 trillion agricultural, $32 trillion commercial)

Bonds---$124 trillion

Equities---$109 trillion

Gold---$12 trillion

Crypto---<$2 trillion

In other words, a 10% loss in real estate values carries 3 times the pain to global wealth than a similar loss in equities or bonds.

China is particularly vulnerable to what happens with real estate values as the average household has most of their wealth invested in this sector. The same is also true in the UK and Australia.

|

| Source: https://twitter.com/ssinvestments8/status/1494648296656146433/photo/1 |

Household assets are much more diversified in the United States. Stock market equity investment is the largest asset class overall. No other country has equity ownership that is spread so widely in the population.

However, for households in the bottom 50% in the United States, real estate overshadows anything else when it comes to wealth.

Most real estate is also leveraged with mortgage debt making valuations particularly sensitive to changes in interest costs.

30-year mortgage rates have risen over one percentage point since a year ago in the United States.

@MacroAlf fills in the blanks.

China has recently lowered mortgage interest rates in an attempt to prop up individual home real estate prices even though many real estate developers in that country are increasingly in danger of defaulting on large debt loads.

The future of President Xi may be determined on how well he can manage the increasing problems in the Chinese real estate sector where values are almost 3 times what they are in the United States with an economy that is only 70% as large.

|

| Source: https://naturaldeposit.com/2022/02/20/chinas-real-estate-market-faces-serious-downturns/ |

The real estate market in China will remain on a downward trend in 2022. According to Caixin Global, the sales of real estate of the top 100 real estate developers fell by 39.6% this year.

In addition, sales in January 2022 were down 43% compared to January 2021 for many developers.

Home sales are also falling significantly in the technology city of Shenzhen. The sale of second-hand houses decreased by 60% in 2021. The second-hand house sales declined to the lowest level since 2007.

What goes up can come down.

Leverage is great on the way up. There is hell to pay on the way down.

We saw what happened in 2008 when the real estate market melted down under the weight of easy credit and bad loans. The air rarely comes out of the balloon or the bubble slowly.

Some argue that due to the facts above the world's central bankers are boxed in. They cannot allow real interest yields to increase without risking crashing the entire world's financial system.

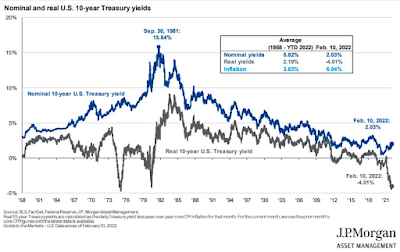

Real yields have been this low before in the United States. However, not in combination with historically low nominal yields at the same time.

How does the financial system work if those with the capital to provide loans have little prospect for a return on their money?

Thousands of years of human history suggest that it does function very well under these conditions.

As a result, someone's wealth is at risk and will pay the price to eventually put things back in equilibrium.

You can only defy gravity for so long.

My advice---watch your wealth carefully---wherever it is.

No comments:

Post a Comment