The U.S. House of Representatives passed its $1.9 trillion Covid Relief Act in the wee hours of Friday night.

Not one Republican voted for the legislation. All Democrats voted for the bill except for Jared Golden-ME and Kurt Schrader-OR. If you thought that Joe Biden was going to usher in a new bipartisan mood in Washington this might be a clue that your hopes have been a tad too optimistic.

The legislation now goes to the Senate.

It is also important to keep in mind that this is the fourth major piece of legislation in the last year that has been stated to be for Covid relief. The price tag for the previous spending? $4.4 trillion.

If the Biden Covid relief package is enacted we will have spent $6.3 trillion in one year reacting to the virus.

Let's put that amount in perspective.

In the year before Covid-19 hit, we only collected $3.5 trillion in total federal revenues.

We spent $1.3 trillion on federal discretionary spending.

We spent a grand total of $676 billion on defense in 2019.

Do you remember when the Democrats talked about how fiscally irresponsible the Trump tax cuts were when they were passed in 2017?

Coincidentally, the Trump tax cuts also had a net cost of $1.9 trillion.

However, that revenue cost was over 10 years and did not consider the feedback benefits from additional economic activity resulting from the tax cuts.

We are close to spending 10 times that amount on Democrat Covid relief in just one "relief" bill and this is after we have already spent $4.4 trillion on other relief packages in the last year.

The one portion of the legislation that most voters seem to be aware of in the bill is an additional $1,400 stimulus check for individuals.

A recent poll showed that 76% of voters either strongly support (52%) or somewhat support (24%) the $1.9 trillion package.

Of course, there is little doubt that 99% of voters have no idea of what is in the bill other than the $1,400 check they expect to get.

How many know that the cost of the individual stimulus checks make up only about 20% of the total spending ($422 billion) in the package? In other words, if the entire $1.9 trillion was allocated to individual stimulus those checks would be over $7,000 per person.

Where is the $1.5 trillion going that is not being spent on individual stimulus checks?

The Democrats have stated that a large portion of the Covid relief money is going to schools to allow them to reopen.

Joe Biden has stated since he was running for President that schools could not open unless there was more money for increased testing, improved ventilation systems and additional funds for increased social distancing in the classroom.

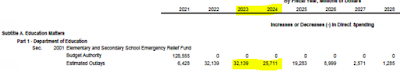

The House bill provides for $128.6 billion for the Elementary and Secondary School Emergency Relief Bill. This is on top of $112 billion that has already been made available to schools in previous Covid relief packages.

However, only $6 billion of the $129 billion in proposed outlays is to be spent in 2021. That is only 5% of the proposed school spending in the bill. The bulk of the outlays are proposed for 2022 to 2025 raising the question as to what this has to do with opening the schools and Covid?

$350 billion is also scheduled to go to provide an additional $400 per month in unemployment benefits. This will actually be an increase in the current $300 supplemental benefits that are being paid and scheduled to expire on March 15.

$350 billion is being allocated for state and local governments. This is primarily being used to bail out states like California, New York, Illinois and other Democrat-run states from the huge fiscal effects the Covid lockdowns have had on their budgets. Of course, a lot of these impacts have been self-inflicted and include financial problems related to unfunded pension plans for state employees that pre-dated the virus.

It includes $120 billion for an expansion of the child care tax credit. The Trump tax bill had already expanded this at a 10-year revenue cost of $573 billion.

The Covid "relief" bill also includes $100 million for a Bay area subway tunnel (Pelosi pork) and $1.5 million on a bridge in New York state (Schumer swamp dollars).

You can be sure there is plenty of other pork and swamp dollars buried within the bill's provisions.

If you are a federal government employee, the bill would also allow you to take up to 600 hours of paid leave time to care for school-age children who are not in school full-time.

$570 million in the new fund is available through September 30. Federal employees caring for others due to Covid-19 are eligible for paid leave. Among those eligible are those who are “unable to work” because they are caring for school-aged children not physically in school full time “due to Covid-19 precautions[.]”

The new Fund allows a federal employee “caring for a son or daughter” to qualify for the paid leave, specifically:

“if the school or place of care of the son or daughter has been closed, if the school of such son or daughter requires or makes optional a virtual learning instruction model or requires or makes optional a hybrid of in-person and virtual learning instruction models, or the child care provider of such son or daughter is unavailable, due to Covid-19 precautions;”

I guess if you don't work for the federal government and are in the same situation---TOUGH LUCK!

The House bill also includes a mandated $15 per hour minimum wage.

The Democrats claim that it will lift 1.3 million workers out of poverty. However, the Congressional Budget Office has estimated that it will also result in 1.3 million losing their jobs. That looks to me like a net loss overall. 1.3 million workers get some type of wage boost to get out of poverty. However, 1.3 million will lose their wages completely. How is that a positive for the economy and our country?

Even before this 'relief" package passes we have now reached the point where 27% of all income in the United States is coming from government transfer payments.

|

| Source: https://cms.zerohedge.com/s3/files/inline-images/govt%20transfer%20payments.jpg?itok=2ksssm-g |

"Relief" is quickly becoming reliance.

Of course, that seems to be the objective of the Democrats in all of this anyway.

No one can question the need for some type of relief but this is way, way, way beyond a relief package.

What I find most interesting is that the recession we are in has not been caused so much by the virus but our governments' reaction to the virus.

That reaction has also resulted in additional reactions that are resulting in unheard levels of money printing and unfathomable debt burdens that will be inherited by future generations.

All of this leads to this rather remarkable graph that shows that the net worth of the BOTTOM 50% of all U.S. households has actually increased by 20% since the Covid recession began.

In the Great Recession of 2009-10 these same households lost 84% of their net worth.

|

| Source: https://twitter.com/TaviCosta/status/1365852066132881415 |

The net worth of all U.S. households increased by $11.7 trillion in the first six months of the Covid recession driven by escalating house prices, an increasing stock market and low interest rates facilitated by the Federal Reserve's monetary policy. It has expanded much more in the last six months.

We are no longer in need of a lot of relief.

The fact is that we have become extraordinarily reliant on government in every form.

The Democrats like it this way.

It may feel irresistible in the short term but it will undoubtedly prove to be regrettable in the end.

No comments:

Post a Comment